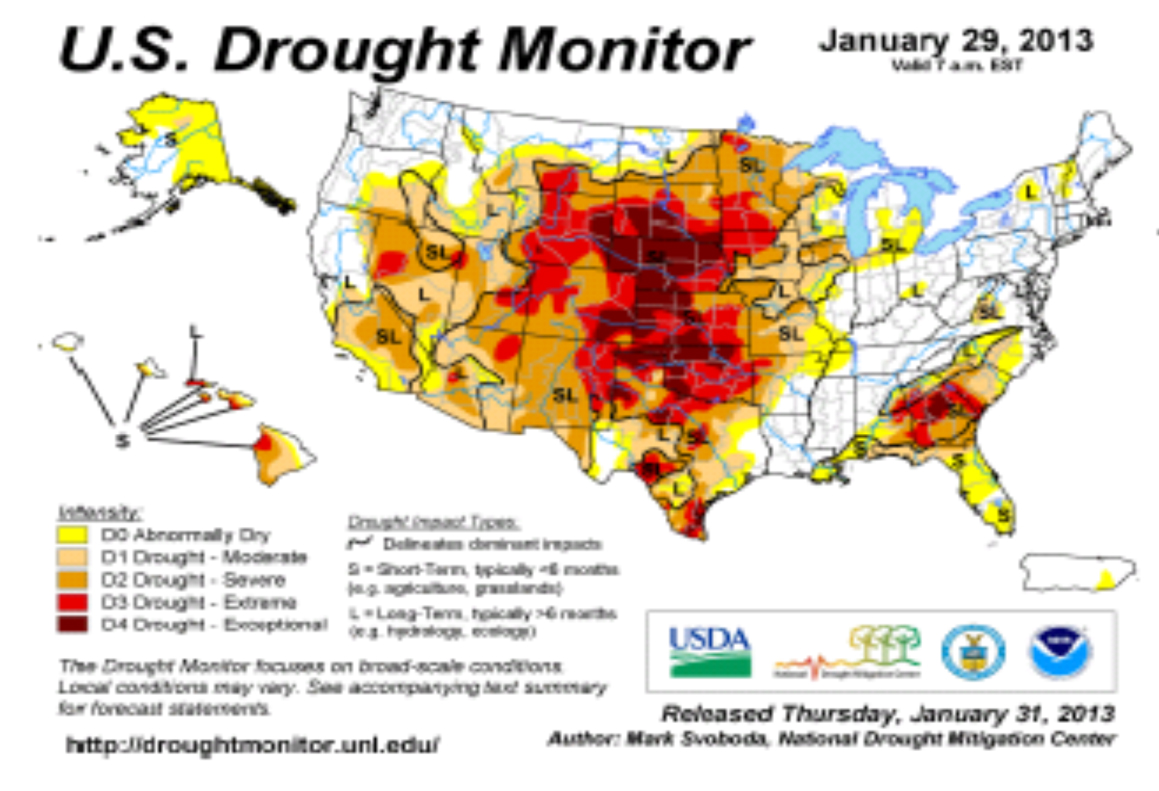

After last summer’s severe drought across some of the major grain production areas of North America, we have been distracted by the lack of sufficient precipitation to restore the soil’s moisture, and a nagging suspicion that this could happen again. The news has reinforced this concern, with headlines about the low water levels in the Mississippi, and other river systems, and the lack of snow accumulation further north. The scorecard for measuring soil moisture is the United States Department of Agriculture’s Drought Monitor Index, and as you can observe from the January 29, 2013 update below, a significant portion of the United States is under severe drought conditions now.

Normally, I don’t put a lot of stock in weather forecasters. It seems that when we’re trying to make hay in the summer time, they can’t seem to give us a forecast that’s accurate for the next seven days, so why should I bet on their ability to predict the weather for the next seven months? The difference of course, is that the Drought Monitor Index is not a forecast, but rather a measurement of the actual conditions. Soil moisture conditions are dry now, and if we were trying to grow a crop in January, it would not be growing very well.

Soil moisture is one of the most significant forces influencing the grain futures markets right now. In spite of the fact that South America is about to start harvesting a soybean crop that is expected to be about 28 million tonnes bigger than last year’s crop and early estimates on 2013 U.S. corn crop planting intentions are 3% larger than the previous record, the futures are having a tough time easing lower while there is substantial uncertainty about the prospects for good growing conditions in the year ahead. Mid-winter is a curious time to be focusing on precipitation rates. At this point, the winter wheat should be in dormancy and the spring crops are still in the seed bag, but with North American corn and soybean ending stocks at all time lows, (the projected carry outs are less than two weeks consumption), due to last summer’s drought ravaged crops, nobody can afford to get caught short again.

The Drought Monitor Index is not a secret; it’s already available to everyone, so the market values today already reflect the existing soil moisture situation. Don’t wait for prices to take off when the market finds out how dry it is, because they already have, and the market already knows. In terms of making marketing decisions for your own operation, expect any improvement in the soil moisture to drive values lower, but if the situation persists, and the drought index worsens, grain values will move higher accordingly. Until the drought conditions alleviate, the market will be preoccupied with the drought, so, as participants in the grain market, we need to constantly monitor the situation. It is the compass which is giving the market its direction.