Since the start of the calendar year, grain supply and demand reports have all been built around estimates of the 2015 crop yield. As we move from estimating crop size to measuring it with real harvest data, the market is digesting the reality of the 2015 crop. The highly variable weather during the growing season has created a situation where there are areas of substantially reduced corn yields, but there are also regions which will enjoy excellent production in this crop year. It’s not a “one price fits all” market with such big regional disparities in supply.

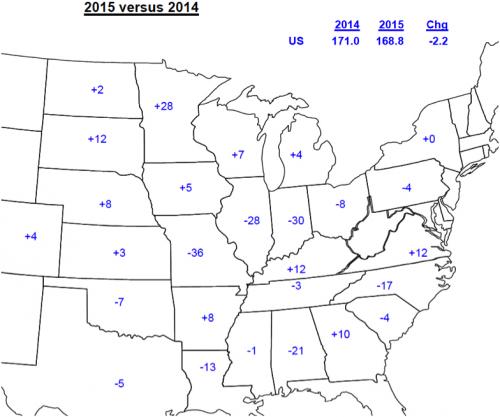

The map below was created by FC Stone and shows the estimated difference in corn yields between the 2014 and 2015 crop years. Most of us are very quick to notice that some key corn-producing states, such as Illinois, Indiana, and Ohio, are all forecast to have lower corn yields — 28, 30, and 8 bushels per acre less corn respectively. If we focus our price expectations fully on those states, it gets tough to reconcile the current year’s crop conditions with the price.

The figure on the chart which the corn market is focused on is not tied to any one particular state but rather to the aggregate total of the whole U.S. production. Despite some states expecting substantial yield reductions on 2015 crop corn, the average yield across the whole country is only expected to be 2.2 bu/ac less than it was in 2014 (and 2014 was a record production).

There is some significant market potential for Ontario corn producers in the fact that the states with strong corn yields are primarily west of the Mississippi, and the regions with the poorest corn crops are along the south shore of the Great Lakes which fortunately are nearest to our supply. A reduced corn yield in Ohio doesn’t do very much to impact the Chicago futures prices for corn, but it makes it substantially easy for Ontario corn to cross over to the New York State users as our corn becomes the most convenient replacement source for their end use customers. Commodities flow much like water through a hole in a dam. If our corn is closest to the area of diminished supply, then our production gets the easiest access at filling that demand, but don’t expect those areas of lower corn production to drive the Chicago futures market. Instead, Ontario’s access to U.S. demand will be expressed in the basis component of price.

Just like corn yields are not equal right across North America, neither are the corn ending stocks or “carry out” from the 2014 crop year into 2015. In much the same way the 168.8bu/ac average yield isn’t the same, the 1.9 billion bushel carry out, (14% of last year’s total production), doesn’t mean that 14% of last year’s corn is in every bin everywhere. Eastern Canada’s supply of old crop corn will be very close to zero by the time that the combines move into new crop next month. The tight old crop inventory has made old crop basis levels extremely high in recent weeks, and moving into harvest with the pipeline essentially empty will also prove useful for Ontario cash prices.

The key to marketing corn in the months ahead is going to be in merchandizing our geographical advantage over the rest of the continent. Unless harvest in the western corn belt turns out to be far worse than the market’s expectation, there’s little cause for buoyancy in the CBOT futures values beyond $4.25 until we hang up our 2016 calendars. Our opportunities lie in the fact that the Eastern Corn Belt has a relatively small yield, and our inventory is starting out at extremely low levels.