For the past month, the agricultural news has featured headlines on the deteriorating crop conditions for wheat in several of the world’s key production regions. The U.S. southwest, the Black Sea region of eastern Europe, and Australia have all been featured in news releases about drought, extreme cold, and other conditions which should spell trouble for a successful wheat crop, and yet the market has failed to react to information which should be sending values higher.

There’s a classic children’s story about a race between “The Hare and the Tortoise,” where a rabbit and a turtle engage in a race. In this story, the hare takes off to such a substantial lead that it has time to nap, while the tortoise plods along behind. In a lot of ways, the situation in the wheat market that we find ourselves in today is similar to this children’s fable. This past summer’s North American drought raised the value of corn and other feed grains to such a high level, that wheat became price competitive with locally produced feed grain. Like the rabbit in the children’s story, the Ontario wheat price got so far ahead of the plodding turtle which is the rest of the world’s wheat market, that now the local wheat values are standing around waiting for the rest of the world’s prices to catch up.

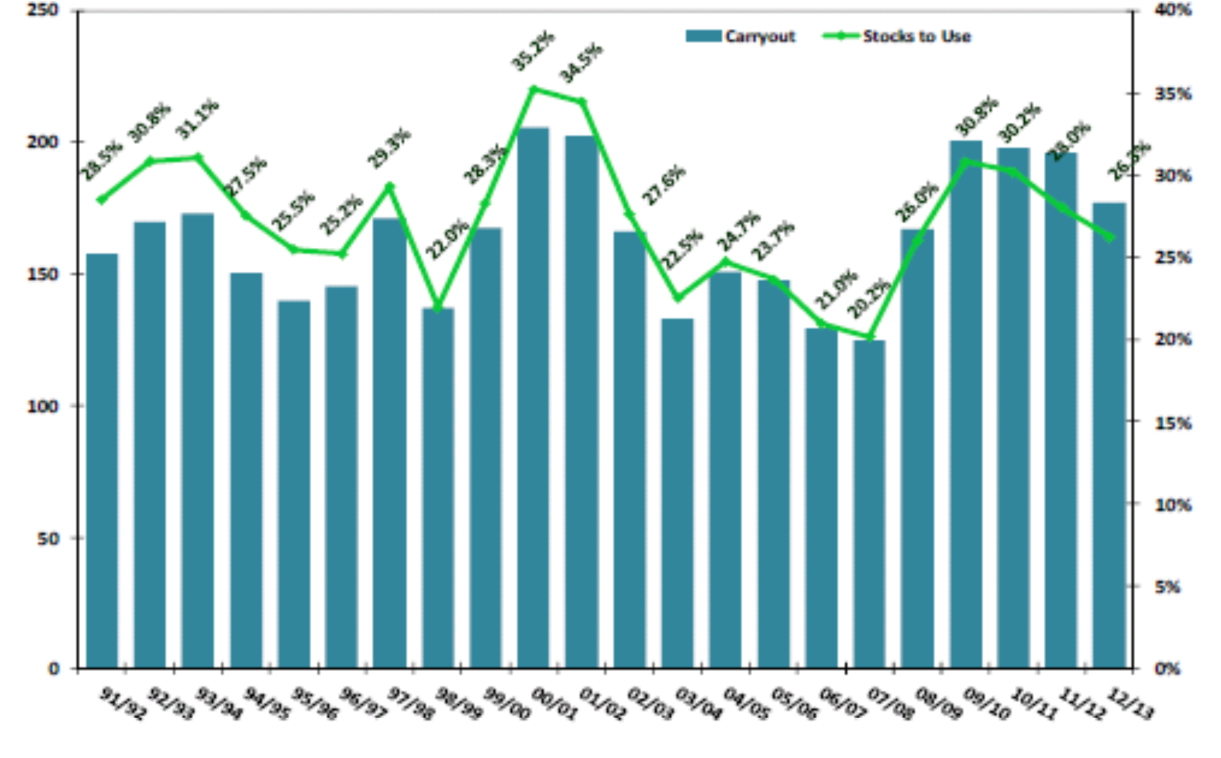

The graph below shows the world’s wheat supplies in terms of Stocks to Use Ratios for the past 20 years. Without dwelling too much on the detail, the bottom line is that with about 27% of a year’s supply of wheat in ending stocks, the supply situation is far from precarious. With higher priced North American wheat stocks, (due to its substitutability for corn in feed), and reasonably large wheat stocks in other regions of the world, our wheat exports have trailed behind expectations for much of the past crop year. The futures markets have drifted lower on the reduced export pace, but in recent weeks we have seen U.S. wheat exports improve, which means that the gap between our prices and world values is starting to close.

The take-home message for producers is that the news regarding tough wheat crop conditions in other parts of the world is correct. Essentially, the fundamental forces behind the wheat market are the exact opposite of the forces behind the corn market. In corn, we had a small crop in 2012 with much larger prospects for the 2013 production. In wheat, we’ve come through 2012 with very comfortable supplies but face the risk of a serious decline in production in the year ahead. The slow moving tortoise of the world’s wheat markets is still plodding along back there, and the race to higher prices will resume when he catches up.