The North American agricultural commodity markets trading patterns correlate very closely to the market information which is released by the USDA. It has become the common culture of the farming community to believe that the USDA is right when prices are going up, and that they are wrong when prices are going down.

Because of the record large corn crop in 2013, the market needs to have record large corn usage in order to utilize the production. Price is the regulator of demand, so if we can effectively consume the crop at today’s values, then price can remain stable, but if we are falling behind on consumption, then prices will certainly soften.

There are four core areas of demand for corn. The first is what we refer to as “industrial” usage, which is for human consumption, sweeteners, or resins. There is relatively inelastic demand for these products, so we don’t see significant changes in this area of usage and North American demand sits at about 1.5 billion bushels per year. The second core area of demand is “exports,” which typically deviate a lot based on price. In 2012/2013 with a small crop and the resulting higher prices, exports were only 715 million bushels. They are expected to double to 1.5 billion bushels in the current crop year. Since North America is an island, it is not difficult to measure how much corn is getting on boats and leaving, and to this point in the crop year, it would appear that we are on track to either meet or perhaps slightly exceed the USDA’s demand estimate. The third core area of demand is “ethanol,” which is also forecast to increase its corn usage by about 10% in 2013/2014 over the previous year. With all of the regulations in the fuel industry, it is not overwhelmingly difficult to track ethanol production or refinery blending, and again, the USDA’s estimated demand appears to be achievable. The fourth core area of corn demand is “feed,” and this is where estimated usage gets difficult to verify.

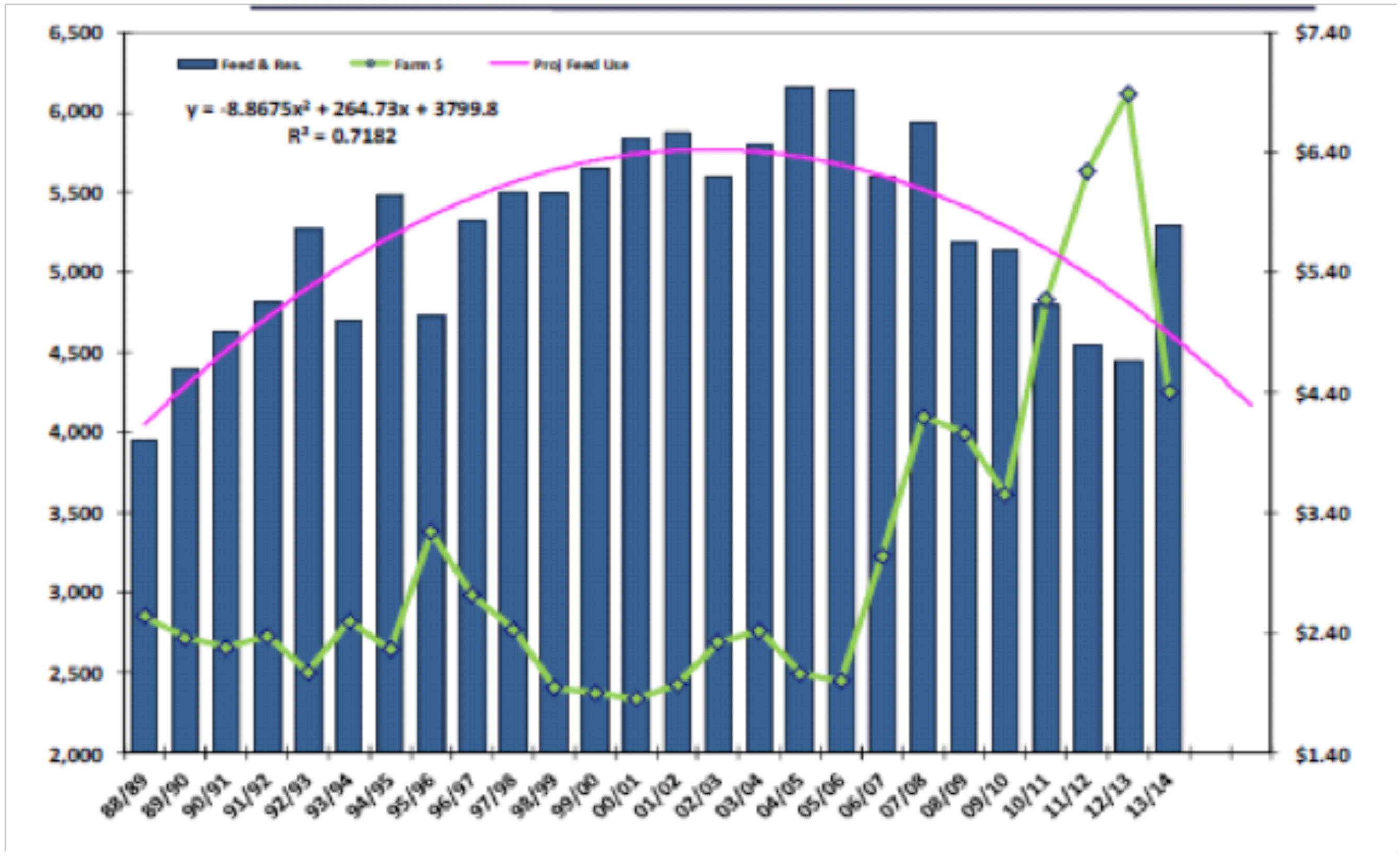

The chart below is based on data from this past month’s report on corn supply and demand and shows the amount of corn which is expected to be used for feed in the United States this year compared to the previous 20 years.

The firs thing that is obvious in the chart is the massive increase in estimated feed demand in this year over the last five years. The demand for corn for livestock feed has actually trailed off in the age of ethanol as the ethanol by-product, (distiller’s grains), has forced its way into rations, and as the higher corn prices created by this new form of demand have caused feeders to look for alternative sources of carbohydrates in their feed programs. The real challenge with such a high estimate of feed demand for corn is that unlike the other uses, where consumption is easy to measure, it is extremely difficult to either verify or refute the USDA’s suggestion that feed demand will exceed 5.2 billion bushels in the current year.

The trick with a good lie is that it is difficult to authenticate. Most of the metrics which we have in order to verify feed usage, such as livestock on feed numbers or slaughter rates are impacted by other variables like carcass weights, or even outdoor temperature. Regardless of my opinion, if you are going to hold corn going forward, you have to believe that the 5.2 billion bushels of feed demand is right, otherwise ending stocks grow and price plummets. Either way, an unverifiable number is easy to tweak, so as subsequent corn S&D reports come out from either the USDA or other sources, feed demand will be the first number to check.