If you have been following the news reports over the past few months on soybean plantings, it’s impossible not to notice that acreage intentions for this oilseed crop are up essentially everywhere. Close to home, here in Ontario, it is estimated that 45% of the province’s 6 million acres of crop land will be planted to soybeans this spring. On a more national scale, Manitoba is expected to plant a record 1.2 million acres, and 2013 might be the first year in history when soybeans surpass potatoes for crop area in Prince Edward Island.

On the global scale, the story is not radically different. Earlier this month Informa raised their estimate of the U.S. soybean crop to 77.12 million acres, following a record sized crop this past winter in Brazil and Argentina. Even the unlikely growing regions are getting on board to plant more soybeans with the Ukraine planting 3.7 million acres this spring. At some point we have to start to wonder when the ever-increasing supply hits the wall from over-shooting demand. The encouraging news is that in spite of our astonishing increases in supply, the global capacity to produce soybeans has yet to catch up to the ever-increasing volume of demand.

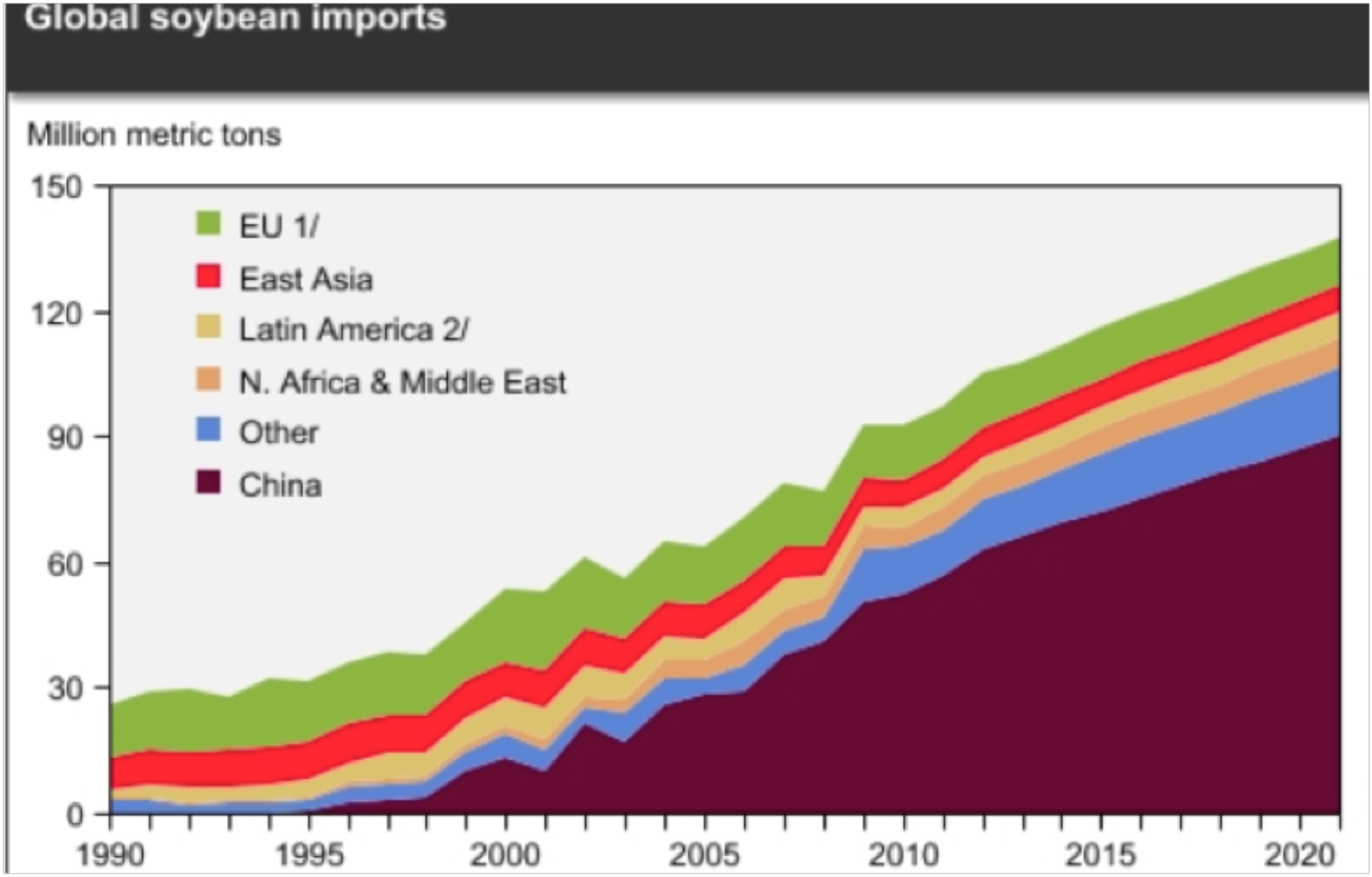

The chart above shows the world-wide distribution of soybean import demand back to 1990, and projecting forward to 2020. (It was produced by the USDA). It is interesting to note that in most areas of the world, the import demand for soybeans has not changed very much in the past 22 years, however, China has grown from being essentially absent from the world soybean market in 1990, to holding the majority of the market in 2012, and is expected to increase its demand by 17% in the year ahead. Suddenly an additional 3 million acres of soybeans in the Ukraine doesn’t seem to matter when demand is increasing at more than 10 million tonnes per year.

Unlike wheat and corn, where an increase in supply will force the prices lower in order to create more usage, demand is leading the market for soybeans. This year’s increase in planted acres, or improved yield prospects due to good weather, will not topple the market out of balance and send people looking for alternative uses for soybeans. Demand growth is big enough to take up all of the slack. Last summer’s drought dropped the average soybean yield in North America to 37.2 bu/ac. If reasonable growing conditions in 2013 move yields back up to a more typical 42 u/ac, then the 10 million tonne increase in production is essentially offset by the 10 million tonne increase in Chinese demand.

It would be naïve to expect soybean values to continue to rally with this year’s North American acreage, but we can market our crop with the knowledge and confidence that there is growth in demand which will consume a large portion of the growth in production. This is not the case with corn or wheat where a bounce back to traditional yields could out supply the existing demand. Based on the increasing volume of export demand, soybean values have firm support. That factor, coupled with the tightest North American stocks on record, will make the soybean market more responsive to summer weather. The challenge for soybean producers over the 2013 growing season will be to pick price targets and make incremental new crop sales to cash in on some of the anxiety surrounding a crop in such enormous demand.