As kids in school we were taught that we needed to learn history so that we didn’t repeat the mistakes of the past. Other than learning not to invade Russia in the winter, I am not certain that I’ve taken much away from my high school history lessons, but the concept of looking back into the way that the markets have behaved under similar circumstances does provide a useful pattern towards predicting where it might be headed next.

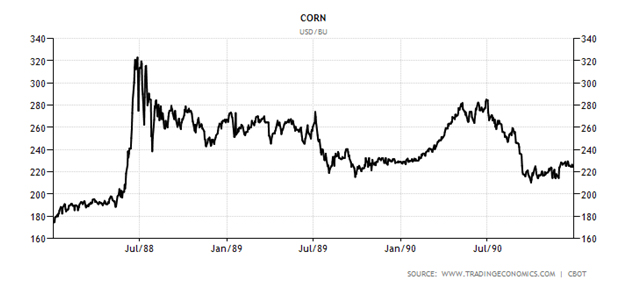

If you are looking for a historical example of the type of corn market that we are in today, simply roll back the charts to 1988 through 1990 and you should have a reasonable roadmap of the route that the market is going to take. 1988 was a drought year in the continental US which resulted in significant yield reduction and a very small corn crop. In 1989 farmers buoyed by higher prices planted a much large corn acreage and with adequate rainfall, yields returned to normal levels resulting in a record corn crop at diminished prices. With 1989 larger acres and bigger yields cooling off the grain markets, things leveled out and returned to normal in 1990. When you consider the impact of the drought in 2012, and the resulting record sized crop in 2013, it appears likely that the 1988 through 1990 chart will be an effective template for forecasting market activity today.

It’s almost erie to look at the chart above and see how much the past 14 months of the corn market have copied the same period 14 years earlier. In June – July 2012 corn prices rocketed higher as last summer’s drought ravaged yield potential, (essentially identical to the same period in 1988). Through the winter and spring of 2013, corn prices held firm, but never repeated the highs of the summer before, and then plummeted in mid-summer as this year’s big crop developed showing significant yield potential. (again it repeated the market’s behavior through the same period in 1989). It stands to reason that if the market has chosen to follow this path, we should use it to provide guidance with respect to what potentially lies ahead.

We are not apt to make much money looking back, so the usefulness of the old chart is in being able predict what is likely to happen next, and then making marketing decisions in order to avoid the pitfalls. Using the 1989 template, it appears that corn prices moved into the harvest lows we before the crop had actually started to be harvested, and remained largely unchanged until into the spring of the following year when planted acreage for the 1990 crop was smaller and the market began to trade crop conditions rather than inventory. One of the common perils of the grain business is that storage rarely pays in years when a lot of crop gets tucked away. Essentially what happens is producers run out of cash at about the same speed as the end users require grain, and the net result is flat prices like we observed in 1989 – 1990. If your marketing plan is to store corn, forward contract the carry on at least a portion of the tonnes that you plan to put away, because it is unlikely that the spot market will earn the kind of storage returns that the futures market is currently showing at least until the market starts reacting to 2014 crop conditions.

Another interesting thing to note from our historical example is that the price of corn was far more volatile in the late summer of 1989 than it was into the fall once harvest began. Most of the significant price moves occurred in the mid to late summer, and then the market leveled out once the big 1989 crop finally started to flow. If you are looking for a sales opportunity for corn, the remaining 6 or 7 weeks prior to harvest promise to be adventure filled. From now until mid-September we should be prepared to expect sharp price moves with very short durations. 20 cents up and 20 cent down in 2 or 3 day windows.

The well supplied corn market created by 1989’s big crop had very little price movement. The first really useful price rallies didn’t occur until the market started to focus on the potential of the 1990 crop. The lowered planting intentions for 1990 and a more challenging spring seeding that year created the first good selling opportunity. If your marketing plan consists of tucking corn away and waiting for the post harvest price rebound, you might need to pack your patience.