The key feature of the soybean markets for the past two years has been the growing world demand’s ability to out run supply. In early 2012, South American farmers experienced a relatively small crop as the result of dry conditions through their growing season which was followed up in the summer of 2012 with a North American drought which reduced yields here as well. World demand for oilseeds, particularly in China, has stayed strong during 2012’s reduced production, and prices have remained strong even with much better production in 2013.

Although the drought ravaged production in 2012 shrank soybean supplies and tightened inventories, the world’s ever increasing appetite for soybeans has done great work in consuming the available supply. Even with a 43-bushel per acre average yield in soybeans this past harvest resulting in a 3.2 billion bushel supply, the ending stocks are still only projected to be around 145 million bushels, a mere 52% of the 2011 crop carryout of 275 million bushels. It is this pace of consumption which has held soybean values in the teens through the past year.

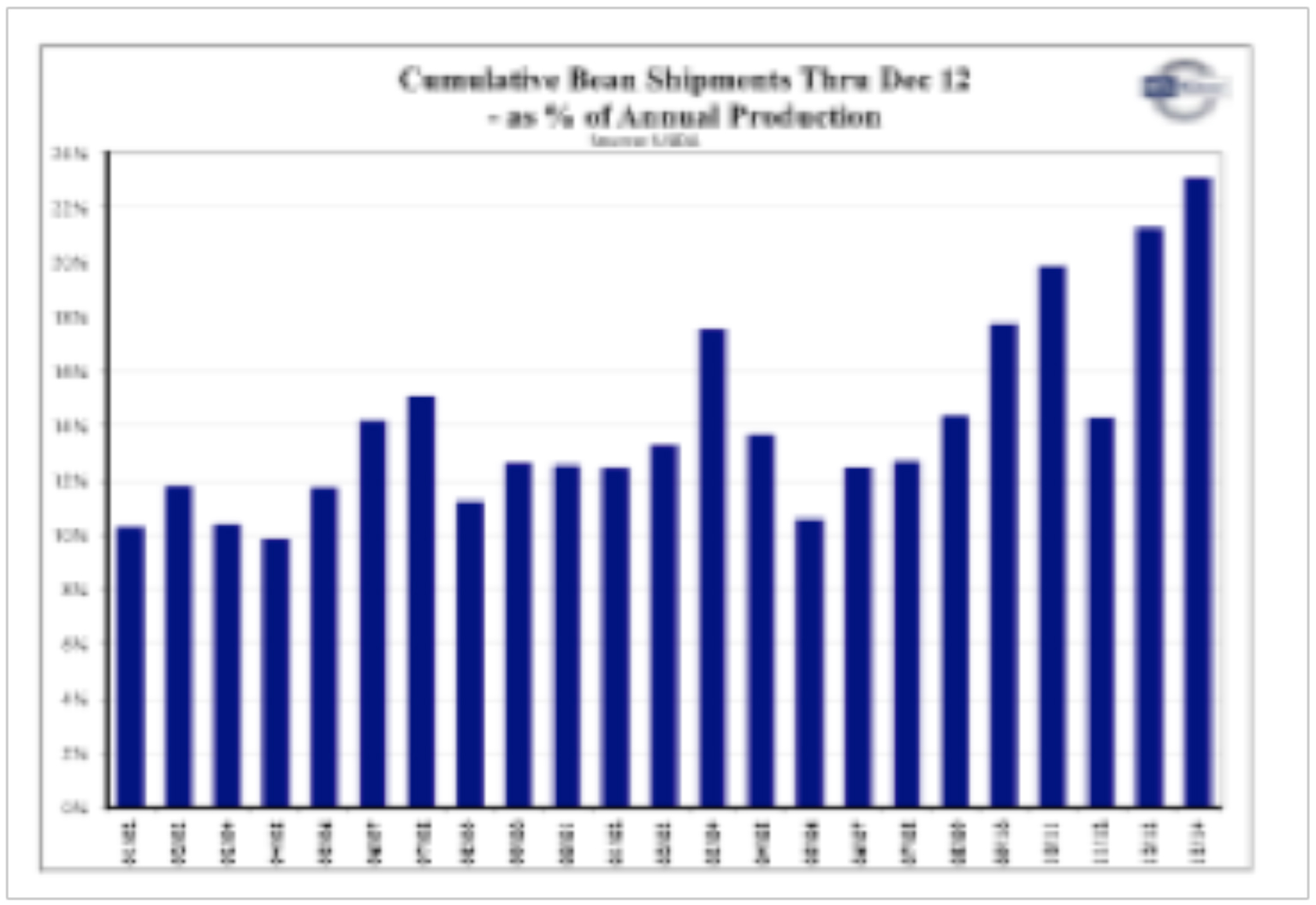

One of the things which the North American marketplace has done extremely well this past harvest has been to evacuate soybeans from the continent. The chart below shows soybean exports as a percentage of the total crop production, the key take away is that inventories are tightening due to the rapid pace of exports. North American soybean supplies will remain low right through to the start of next fall’s harvest.

The current balance in the soybean market is the off set between extremely tight ending stocks from the 2013 production and record large plantings for 2014. Brazil alone has increased its soybean acreage 4.8 million acres over last year, jumping from 67.2 million acres in 2013 to 72.1 million acres in 2014 making Brazil’s projected harvest this spring to be in excess of 85 million tonnes. If the market only traded old crop supply, prices would certainly have good reason to firm, but with a record South American harvest only a few months away, soybean buyers can’t seem to find the justification to run values higher.

There are two factors that are going to help the market to make its decision about where prices should head. The first is South American weather, (which has been an uneventful year to date but generally musters at least one good rally), and the second is North American planting intentions for 2014.

With the corn market currently fantastically “unencouraging,” there is a strong likelihood that we will see higher North American soybean acres in 2014. The current ratio between 2014 crop soybean to corn in cash prices is 2.6:1, and typically one would expect this to push acres towards soybeans. Fundamentally, the soybean market has very little to trade on other than planting intentions from now until we actually get to planting season.

A larger North American soybean crop on the heels of a record South American crop does not provide much cause for a sustained price rally. North America’s domestic crush market for soybeans is only about 1.65 billion bushels, (about 50% of the total crop), and the rate of consumption does not deviate much with price. Therefore any increase in supply needs to be consumed in the export market which positions the North American farmer in direct competition with his South American rival. 2014 is likely the year to be playing defense on your soybean marketing plan, and taking some of your risk off the table by making some early sales will prove to be a safe decision.