The crazy thing about living in this modern information age is how to make sense of all of the data presented to us, and then to be able to distill it down into the rational things that help us to make better business decisions. As producers of agricultural commodities, the only truly useful information is the knowledge which helps us to anticipate grain prices. At the end of the day, everything else is bunk. So how do we shift through an Internet age where every piece of data between soil moisture conditions in northeast China to the potential devaluation of the Brazilian real is at our fingertips – and sort out how all of that is likely to impact my farming business’s income?

One of the quick and dirty ways to estimate the potential value of a commodity is to monitor stocks-to-use ratios and how they correlate to price. Fundamentally this is not any sort of stretch on logic. The tighter the ending stocks, the higher the price is going to be. We all pretty widely accept that scarce things are worth more, so why not use the measurement of relative scarcity as a way of predicting value?

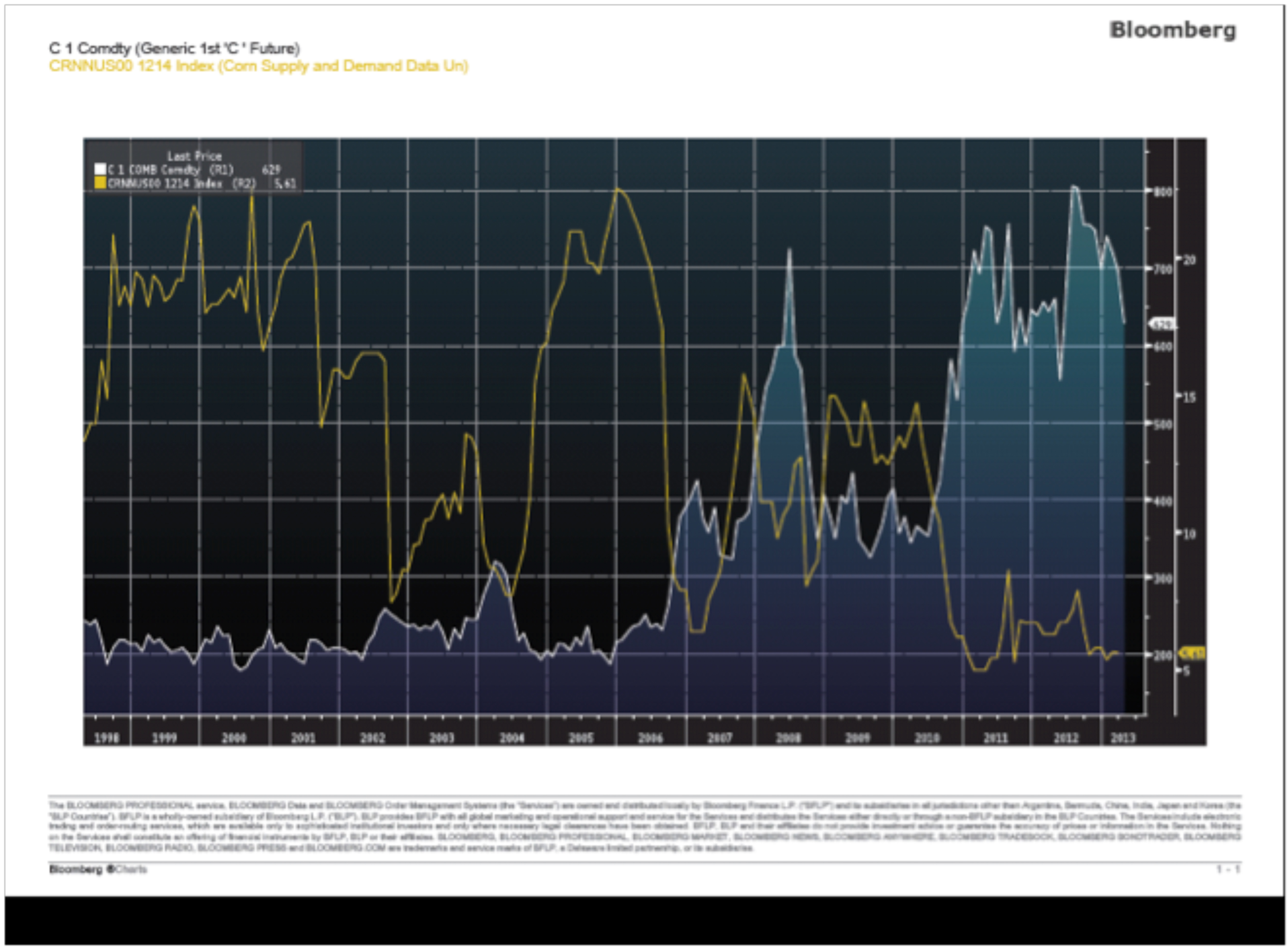

The chart below measures the CBOT corn futures price, (in the grey shading), overlaid on the percentage of ending stocks to use for corn. The idea is to take the information that we collect on ending stocks from the various sources of crop reports, and then cross-reference it to a similar period of scarcity. You’ll get an idea of where the price should be based on that level of supply.

Where this tool works the best is that it enables us to look through the organic fertilizer that flies up from events like the March 28 USDA Report, and gives us the capacity to estimate where price should settle out after the anxiety dies down. Based on the most recent estimates, the ending stocks of corn in the United States should be about 6.8% of the year’s production. That should support futures in the $6.50 to $6.80 range. Curiously enough, that is very close to where the futures values settled out a couple of weeks after the report. As planting gets started and the marketplace starts to get a better sense of the 2013 crop’s supply and demand, you can use the same technique to start setting price targets for new crop marketing decisions. If 2013 crop estimates start placing next year’s ending stocks at 13% - 15%, you already know where the price is going to be. (Or at least a range of the highs and lows to expect when stocks are predicted at that level).

This is not a cutting edge concept. Although the example used here is for corn, it is a widely used system in all commodities, so you can acquire and utilize similar charts for any of the crops which you might have to market, and use them in the same way. The question always boils down to what is this crop worth when stocks are in this range? Getting good at doing this not only limits your chances of under estimating the value of your crops and selling them too cheap, but also stops you from over estimating where the price might go and then having to settle for substantially less later. Like in hunting, your potential to hit the target is only as good as your ability to take aim.

The non-agricultural players in the market use this type of calculation for guidance fairly frequently. You’ll notice that the imbedded chart was created by Bloomberg, and we all know that they don’t spend any time in a corn field. If you want to be able to understand what the spec money is going to do, learn how they make their decisions. They don’t play in the commodity markets to lose money, and you shouldn’t either.