The term “globalization” gets horribly overused in many conversations, but in the case of agricultural commodities like corn and soybeans, Ontario farmers are clearly trading in a global market. All winter soybean prices have held on to the tightness in North American stocks, but with southern hemisphere harvest now in full swing and some end user uncertainty in China, those far away issues are impacting our local price.

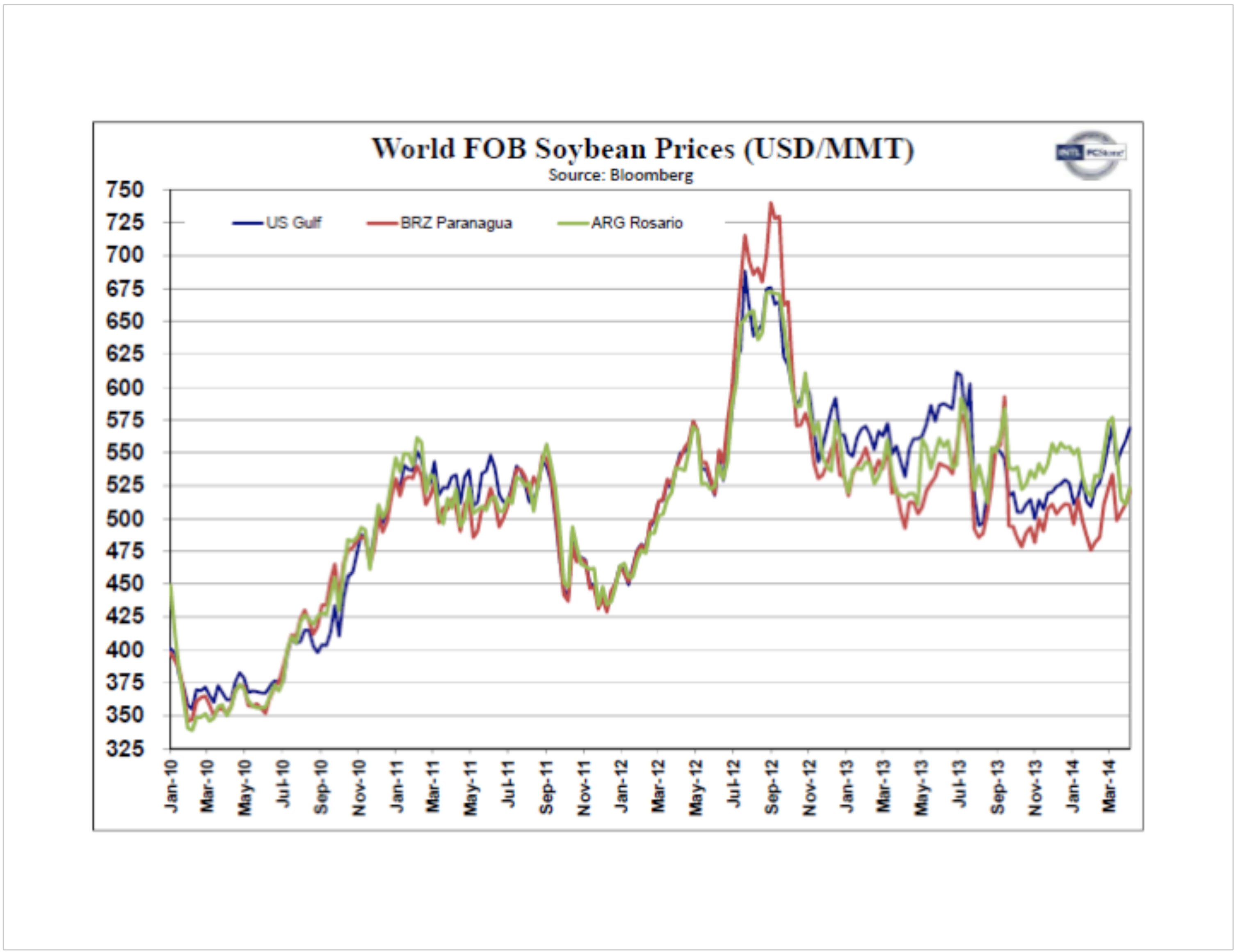

The chart below compares the cash value of soybeans in the world’s three major soybean export hubs: the U.S. Gulf (at the mouth of the Mississippi), the Brazilian Port of Paranagua, and Rosario, Argentina. What is inescapably obvious from the graphic is that whole world’s cash market trades in a very tight range and that no one source area can stray very far from the others in terms of value.

North America has been in a situation of very tight soybean stocks since the drought-shrunken crop of 2012. For the past two years, our stocks-to-use ratio on soybeans has been in the range of 5%, (which is only about twice as many soybeans as we would need for seed). Even the record large planting intentions reported March 31 for North America for this year didn’t rattle values because the stocks on that date were only 998 million bushels (30% of the production with a full six months until the next harvest). The potential problem for bulls in our market is that although the Ontario soybean situation is tight, we are not isolated in the world market. That’s why a credit issue with a Chinese crusher sends Chicago futures for a tumble, which in turn impacts the cheque which an Ontario farmer takes to the bank.

North America has been in a situation of very tight soybean stocks since the drought-shrunken crop of 2012. For the past two years, our stocks-to-use ratio on soybeans has been in the range of 5%, (which is only about twice as many soybeans as we would need for seed). Even the record large planting intentions reported March 31 for North America for this year didn’t rattle values because the stocks on that date were only 998 million bushels (30% of the production with a full six months until the next harvest). The potential problem for bulls in our market is that although the Ontario soybean situation is tight, we are not isolated in the world market. That’s why a credit issue with a Chinese crusher sends Chicago futures for a tumble, which in turn impacts the cheque which an Ontario farmer takes to the bank.

The change for Ontario soybean farmers is in keeping focused on the global market in terms of marketing signals, when they seem to be so far removed from our local situation. What we know today is that our old crop stocks are tight, and our new crop planting intentions are extremely large. Neither of these things are news to the market, and both of them are going to cause a change in price. We are not going to have a meaningful weather situation in our market for at least another six weeks, and this means that essentially the only thing that our prices have to run on in the near term are issues in other parts of the globe. Don’t get caught focusing on the domestic market issues or you will miss what’s really going on.