The temporary American government shut down last month gave us a much-needed reprieve from USDA crop reports. Dave Newsom from DTN cleverly described the USDA as a matador trying to kill all of the bulls in the market, so it would seem that we’ve enjoyed the break from their news releases. However, with the marketplace lacking any report guidance since early September, there is a lot of attention being paid to the upcoming report on Nov. 8.

With soybean harvest essentially wrapped up, it is a good time to take stock of the situation and determine what to do with the balance of the 2013 crop and what to look forward to in terms of 2014 crop marketing decisions.

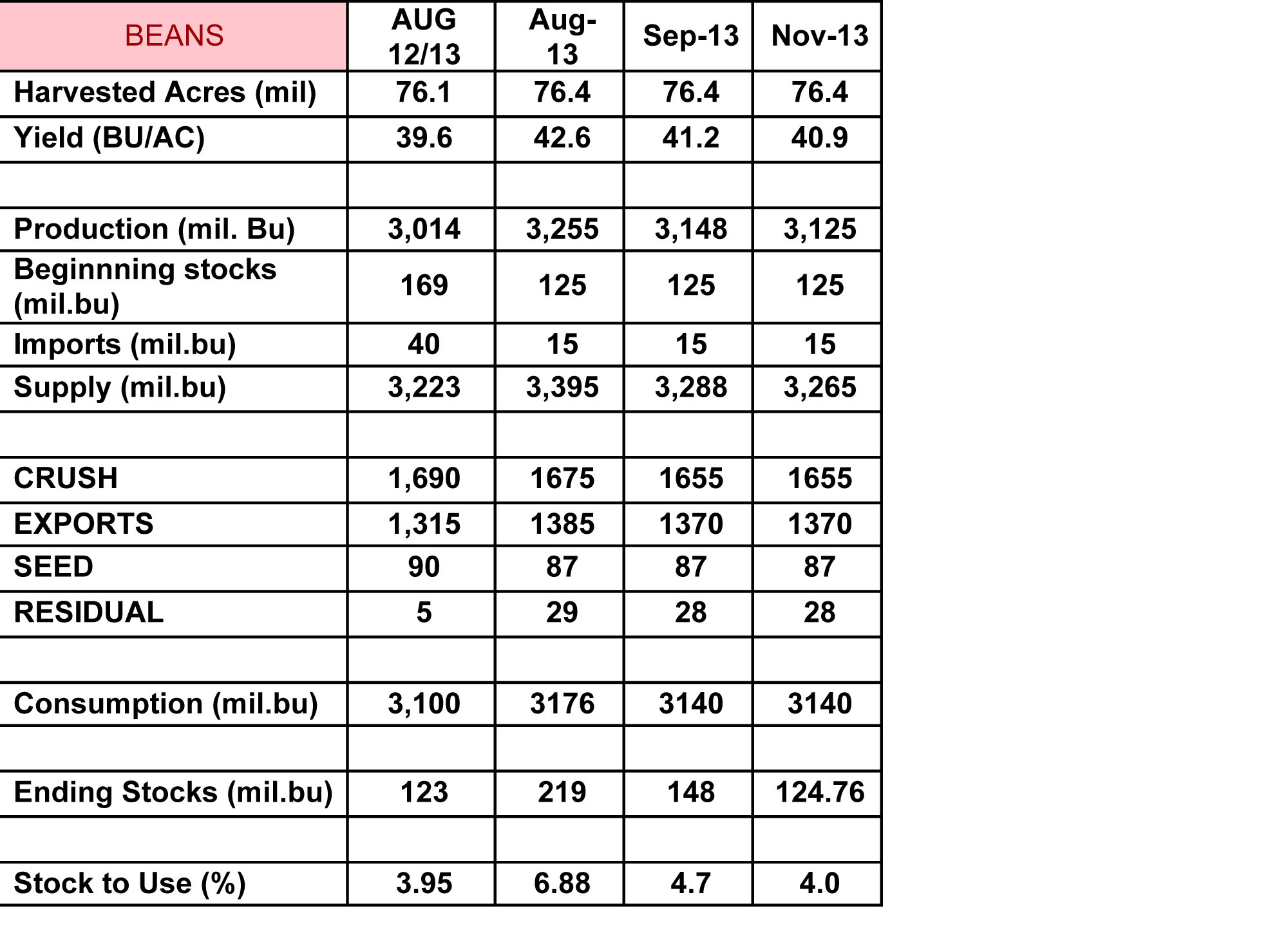

The chart below is an estimate of what the USDA might show as the soybean supply and demand table on next Friday’s report. The key variable to watch is yield. Leading up to the report, the banks and private analysts have pegged the average soybean yield for 2013 at between 40 and 42 bushels per acre.

The National Oilseed Processor’s Association, (NOPA), releases soybean crush statistics weekly, and export inspections are reported weekly, so the consumption side of the soybean S&D is usually very accurate. Yield is likely the only variable which might surprise the market in a report, and, based on how small the range in estimates is, it seems unlikely that we will be rattled by that number either.

What is interesting is how similar the 2012 crop ending stocks and stocks-to-use ratio are to the 2013 projections. With the expected ending stocks within 2% of last year’s and with the stocks-to-use ratio estimated to be within five one hundredth’s of one percent of this past crop year, it would imply that the market has very little to react to. If the purpose of price is to ration demand, and the supply and demand are essentially in balance, then there is really no reason here for the price to do anything.

If you are holding 2013 crop soybeans going into the November report, the question which you need to be able to answer for yourself is: “What reason do I have to keep them?”

The market has a very strong tendency to look forward, and what the world soybean market will be looking forward to in the coming months is the size and condition of the South American soybean crop, (which will dominate the market from November through February), and the planting intentions for the 2014 North American soybean crop. (which will dominate the markets from January through April).

With corn prices substantially lower than they were a year ago, and the ratio of soybean prices to corn prices at around 3:1, it is the world’s worst kept secret that soybean acreage is on the rise and corn acreage is on the decline for the year ahead. Without a doubt there is a lot of weather between now and the next soybean harvest, but a cautious volume of sales for 2014 crop soybeans might be in order in the very bear future. In the absence of a weather calamity in 2014, there is little reason to believe that soybeans will rally from today’s trading range. Being 25% to 30% sold next year’s production is a solid marketing strategy. After all, as a wise cattle feeder once told me, “you can’t go broke making money.”