Yesterday’s USDA Supply & Demand Report fed the soybean bull market quite effectively by reducing yield expectations in a market already well aware of precariously low stocks. Although the news in the September 12 report was widely anticipated, the market reacted rationally and the futures market rallied by more than 30 cents per bushel between the noon release and the day’s close. It’s proof, (one would think), that the market knows how to behave rationally.

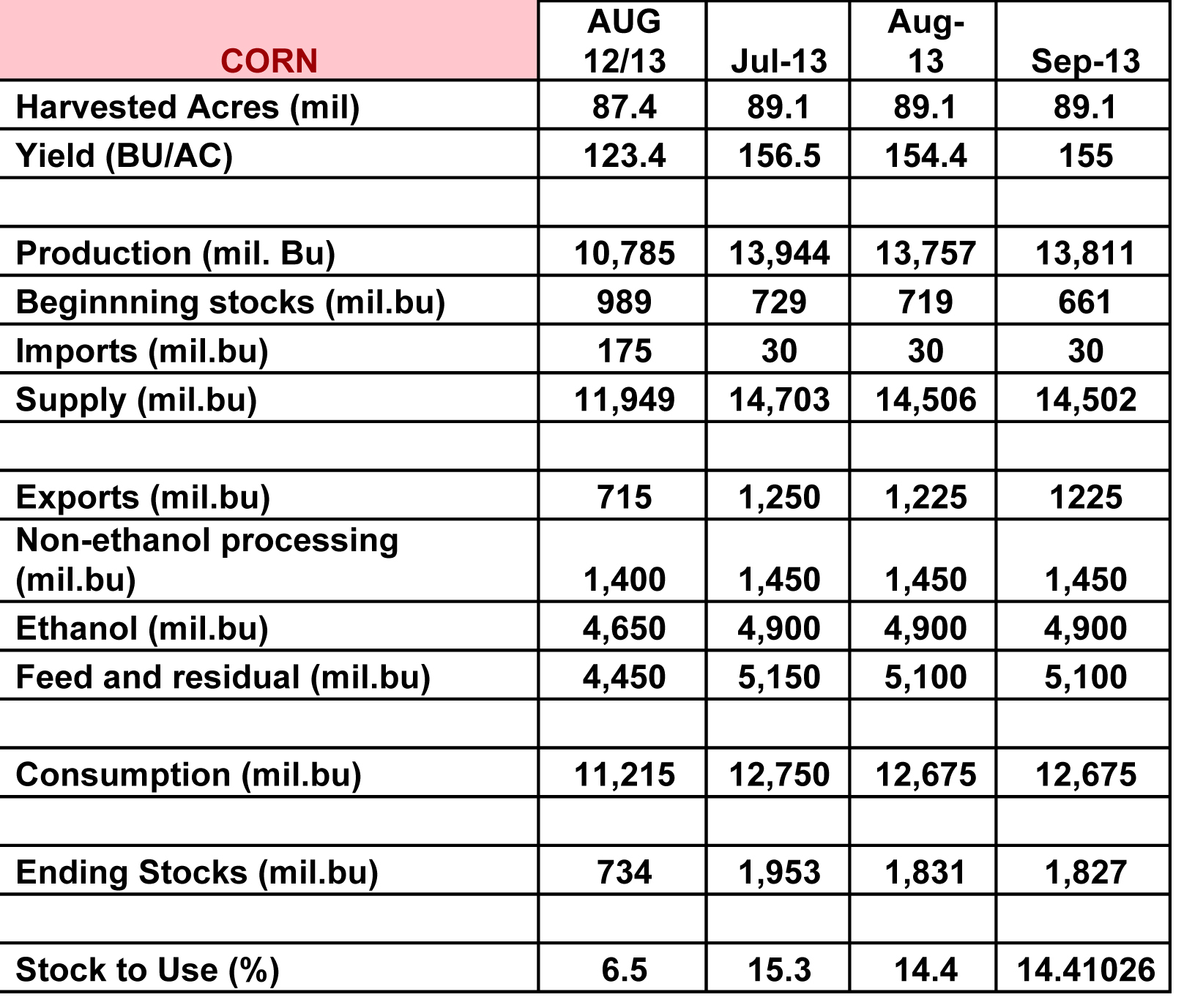

The market’s reaction to the adjustments in the corn S&D really reflect the lunacy of reactive trade. In the USDA’s release, (which is displayed on the chart below), you can see that the authors of the report made two significant adjustments to the corn supply. The first of these is that they raised yield by 0.6 bu/ac from 154.4 to 155 bushels per acre. This adjustment raises the total production estimate for 2013 from 13.757 billion bushels to 13.811 billion bushels. A yield increase was something of a surprise considering crop development this summer, but they are entitled to their opinion.

The second corn supply adjustment in the September 12 Report was a cut in 2012 ending stocks from 716 million bushels to 661 million bushels. What’s really curious is that the increase in production brought about by the rise in new crop yield was exactly off-set by the cut on old crop ending stocks. Since 2013 ending stocks aren’t any different and the stocks-to-use ratio remains unchanged, there is actually no reason for the corn market to react to the September USDA Report. It is in fact, entirely neutral.

What was curious in the moments following the mid-day release of the report was the quick negative reaction in new crop corn futures. It seems as if the speculators started selling corn futures as soon as they saw the revised yield number, and quit reading before they got far enough down the page to see that the adjustment in old crop ending stocks was large enough to entirely neutralize the whole report. The entire first hour of trade following the report was a needles slaughter of bulls in the corn pit. Towards the close, some of the slow readers must have shared the message with the panic sellers that the report wasn’t all that bad and values were able to firm up going into the end of the day’s trading session.

If you are a farmer with corn to market, trading sessions like yesterday’s happen, and the wisest course of action is to find a job to do outside until the sanity returns to the trading floor. Marketing decisions need to be made in facts, not on frenzies, and the fact of the matter is that the supply and demand situation in corn looks a lot like it did in August. No change in information generally means that there is no cause to make any new decisions. The next anticipated major news for the corn market will be the final yield calculations after harvest is completed and the early indications on 2014 planting intentions. Both of those are three months away.