In five of the past eight years, the USDA’s January Grain Spp[ly and Demand Report has created a limit move in the CBOT grain futures on the day of its release. Three of those years, it was limit up, and on the other two, futures prices were limit down. It’s a little bit like watching the bull riders at the Calgary Stampede: there’s no question about whether or not the bull is going to buck when he comes out of the chute, it’s just a question of whether or not he twists right or left on the first jump. In the case of the January 10th report the bull appears to have stumbled.

In the days leading up to the report’s release, the bears seemed to be in control of the CBOT trading pit. Fueled by news like Informa’s increased yield adjustment to 161.4 bu/ac, (pushing U.S. corn production to over 14.15 billion bushels), nervous sellers were evacuating the market and prices eased lower accordingly.

When the USDA report finally dropped, there was nothing there. They increased soybean yield from 43 bu/ac to 43.3 bu/ac, and lowered corn yield from 160 bu/ac to 158.3 bu/ac. There was a nice bounce in prices on the Friday afternoon of the report’s release, but the bounce really just restored values to where they had begun the week before the nervous pre-report bears drove values lower. Having effectively avoided the potential pothole of the January USDA report, is there hope to rally grain values going forward?

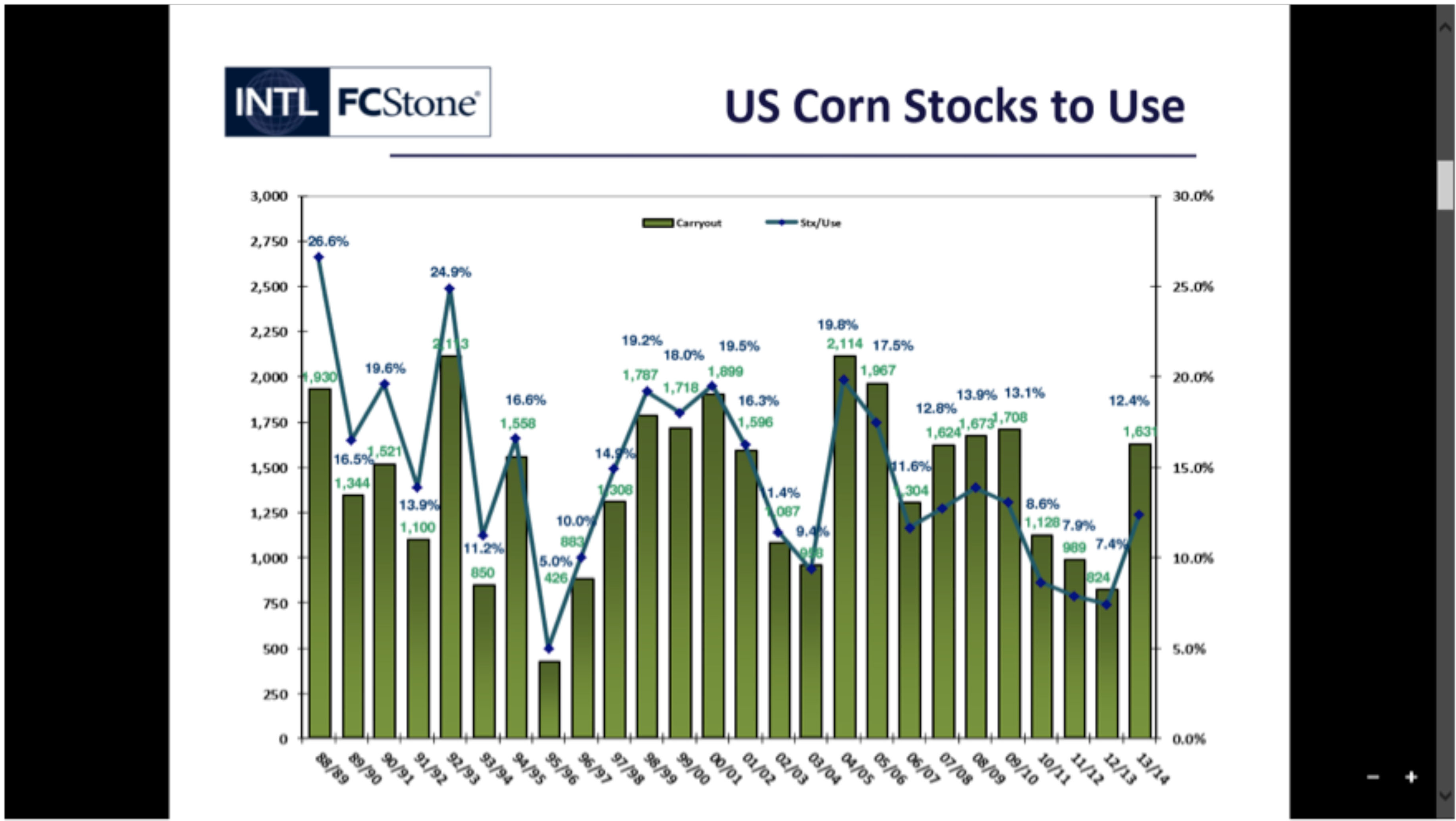

The overwhelming elephant in the room in the 2013 – 2014 grain market is the sheer size of this past year’s corn crop. At 13.9 billion bushels, it is a full 30% bigger than the previous year’s crop, and the record for the largest corn crop ever produced on this continent. Prices have dropped in order to create enough demand to utilize this production, and the lowering of corn values has spilled over into wheat and barley prices as corn’s competitors get sqeezed out of feed formulas. While this is all true in terms of the finite numbers, if you look at stocks-to-use ratios, a broader measure of the anticipated carry out as a percentage of the total use, the situation is not as ominous as the volume of production would make it appear.

Stocks to use is an efficient way to monitor a market, because it takes into account both supply and demand, and boils it down to one simple figure: the percentage of the crop which will be left over at the end of the crop year. The chart below shows the past 25 years of American corn stocks to use, and while you can easily see that the 2013/2014 corn stocks to use is radically higher than the previous year, it is not wildy out of the range that we have traditioally worked under. In fact, if we can maintain the current pace of consumption, our stocks-to-use ratio will stay very similar to where it was between fall 2008 and 2010. Statistically, there is a very high correlation between grain prices and grain stocks to use, so it is reasonable to assume that prices will behave in a similar fashion to what they did the last time that stocks to use was in this range.

Ultimately, this will all result in a fairly uneventful corn market. Just like the recent USDA report, it was barely worth the excitement which came in the anticipation of the report.

Going forward, there are really only two market forces which could cause the market to make any serious adjustments. The first is planting intentions for the 2014 crop, and the second is whether the USDA is fibbing to us about the feed demand in the current reports.

More on those later.