It’s always interesting to watch the funds trading in the Chicago futures market. Because of the sheer volume of money which the funds bring to the market, they have the capacity to influence price levels simply as a result of their entry or exit from the market. Analysts spend an enormous amount of time talking about the fund’s activities, but what does all of this really mean?

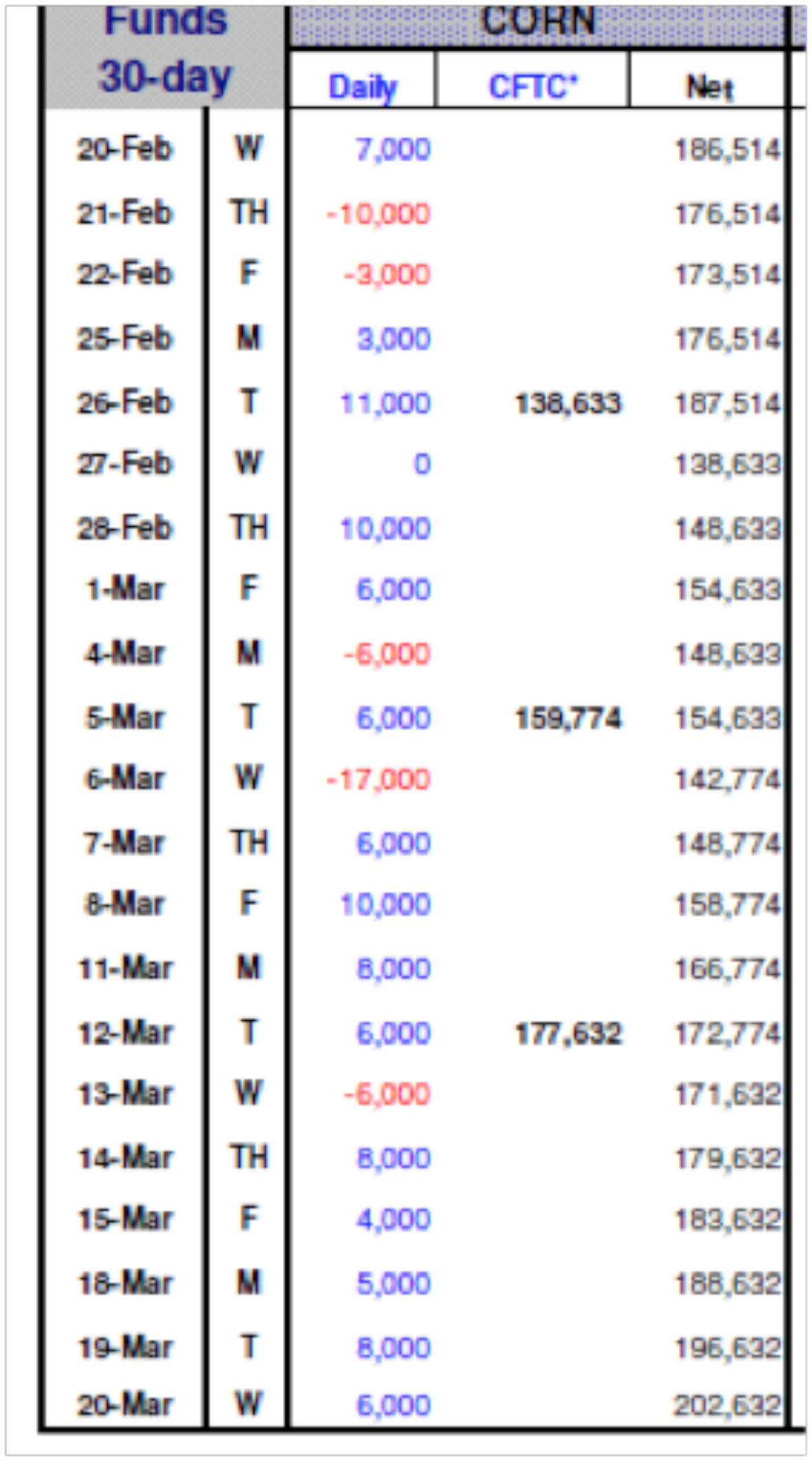

The chart below shows the fund’s positions in the Chicago corn futures on a daily basis over the 30 days between February 20 and March 20. The key feature to note is that the fund’s positions have grown consistently over the past month, to the point where they are now long over 202,000 contracts, and if the funds are buying corn, does that mean that the market is going higher?

If one party buys a futures contract, then another party has sold one. Essentially, the trading of grain futures contracts is the same as sports fans betting on a hockey game. The transactions are a straight off set to one another. The bottom line then, is that if the speculative funds are “net long” in the corn futures, then the commercials must be “net short” the same amount. We have a tendency to think that if the funds are buying futures, then the market must be heading higher, (and for the sake of the fund trader’s job security, we hope they are right), but for the funds to get long, somebody had to have sold it to them. In most cases, the natural off set to the fund’s positions is the commercials, which are the farmers and grain companies. Although as corn producers, we certainly hope that the fund’s decision to purchase is because the price is going up, the bottom line is that they have been able to buy these volumes because producers sold it to them.

If one party buys a futures contract, then another party has sold one. Essentially, the trading of grain futures contracts is the same as sports fans betting on a hockey game. The transactions are a straight off set to one another. The bottom line then, is that if the speculative funds are “net long” in the corn futures, then the commercials must be “net short” the same amount. We have a tendency to think that if the funds are buying futures, then the market must be heading higher, (and for the sake of the fund trader’s job security, we hope they are right), but for the funds to get long, somebody had to have sold it to them. In most cases, the natural off set to the fund’s positions is the commercials, which are the farmers and grain companies. Although as corn producers, we certainly hope that the fund’s decision to purchase is because the price is going up, the bottom line is that they have been able to buy these volumes because producers sold it to them.

When commercial grain companies purchase grain they sell futures in order to manage their risk until such a time as they sell the grain. Funds buy what is available to them, at a price which is attractive to them. The fact that the funds have been able to take up big positions implies that the commercials own a great deal of grain, and therefore have sold futures in order to hedge it. The glass is half full because the funds are continuing to purchase corn futures as these prices, and for them to succeed at this strategy, the price needs to move higher. As long as the trend towards bigger positions continues, the strength will remain.

Where the rally breaks down is the fact that at some point the speculative funds have to liquidate their futures positions, because they do not want to take delivery, and the commercials who made futures contracts available to the funds by hedging, will at some point want to ship the grain. In the same way that bigger volumes accelerate the price moves up, the same volume also adds momentum to the moves downward. The trick for a farmer to have a successful marketing plan is to learn how to anticipate the fund’s behavior and exit the market at the time when the trend is just starting to reverse.

In practical terms the simplest thing for grain producers to monitor is either open interest, (which is the total volume of pending orders in a futures contract), or to simply observe the fund’s positions in a chart like the one above and know that as the fund’s positions start to reverse, the market’s trends will as well. It wouldn’t be totally advisable to build one’s whole farm marketing program around this single market influence, but monitoring it as a part of a set of market indicators like soil moisture, stock to use ratios, and planting intentions would provide a producer with a well-rounded view of commodity prices.