Coming off one of the earliest springs in our lifetimes in 2012 has made the past month frustrating for farmers anxious to get to the field and start working on their 2013 crop. Knowing that early seeded crops tend to out produce ones that are planted later, and that late planting tends to result in acreages being shifted from one crop to another, the slower spring this year has created no shortage of conversation about how this weather is going to impact prices.

What the market is really struggling to do right now is to adjust its values to represent the events in the field. The challenge in effectively adjusting to the new supply and demand situation is that it is still too early to measure the extent of the change.

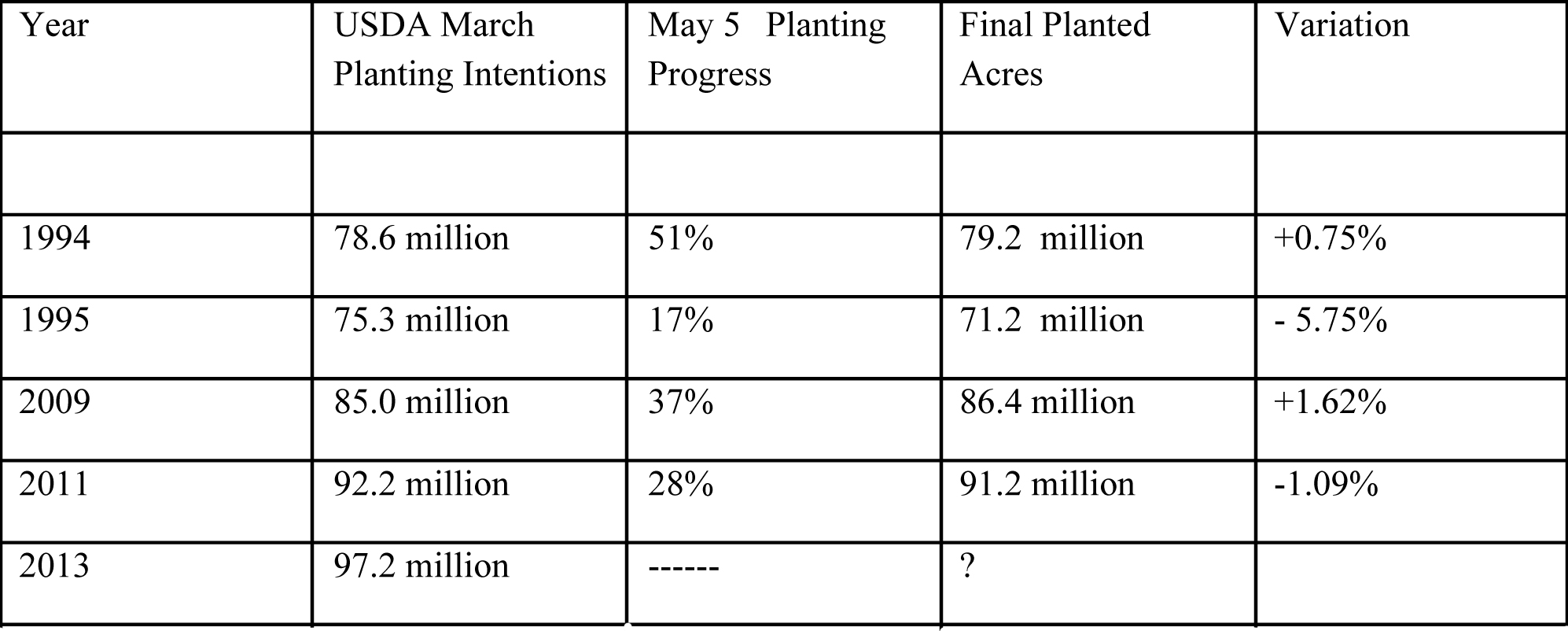

In order to try to anticipate what we might expect from the 2013 corn crop, the chart below compares producers planting intentions, (based on the end of March USDA Planting Intentions Report), compared to the final seeded corn acres and using the planting progress as of May 5, as the filter. In order to keep the graphic simple, the chart covers the fastest and slowest spring planting pace in the last 20 years, (which are 1994 and 1995), and then a couple more recent years with planting paces closer to “average”

What is instantly apparent is that producers like growing corn. On the years with quick planting progress, the seeded acres actually exceeds the planting intentions. Conversely, on years when the speed at which the crop was planted was delayed, (like 1995 & 2011), the final acreage turned out to be below the initial intentions. The reason for most of the volatility in the corn futures over the past couple of weeks has been largely a result of trying to guess the impact of delayed seeding on the potential size of the 2013 crop corn supply.

In the April 12 column, we talked about how to use ending stocks to predict price levels. So if we can accurately predict the potential size of the 2013 corn crop, then we can go a long way towards setting reasonable price targets for the futures market. When the USDA releases its estimate for corn planting progress on Monday, we should be able to plug it into the available historical data and use that to predict how big the 2013 corn acreage is really going to be. Multiply that number by the anticipated yield and you can make the required adjusts to the corn S&D. For example, if planting progress is estimated at 28% on Monday, then the likely decline in the corn crop acreage will be 1.1% below intentions. This would drop the 2013 corn crop from 97.2 million acres to 96.1 million acres and decrease the new crop supply by 170 million bushels.

The good news is that 100 analysts in New York and Chicago are going to do this math, so you won’t have to.

This spring’s commodity price rally is being driven by corn and the uncertainty around the new crop getting planted. Wheat prices have rallied, not because of spring seeding or crop condition issues, (which are equally bad), but because wheat is the obvious substitute for corn in feed, so anything that drives corn prices higher pulls wheat upwards along with it. The losers in a slow spring are the oilseeds. Every acre that gets pushed back too cold, too wet, or too late to plant cereals or corn ends up in soybeans or canola. Everything in the recent market which has been good for corn and wheat is equally bad for soybeans.

Determining the value of grain is not particularly difficult as long as you can predict the supply. It’s too bad that crop size is dependant on the weather, because otherwise the marketing piece would be easy.