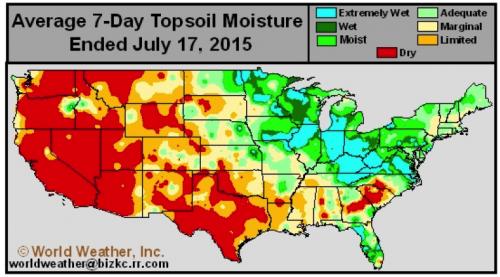

There are very few places having average summer weather in 2015. Whether it is flooding or forest fires, there is a headline in every newscast about how weather is impacting some part of the North American continent. The graphic below shows the dramatic deviations in soil moisture across the United States last week.

If you follow the Mississippi River down the map of the United States, what becomes instantly obvious is that soil moisture east of the Mississippi is more than adequate, (to the point of being excessively wet), and the areas to the west of the Mississippi are dry.

Marketing is easier in a drought because the negative impact on yield is obvious. Price regulates demand, and all that the market has to do is to raise prices enough to shrink commodity demand to the drought restricted supply. However, the 2015 drought rally has been largely limited by the fact that the driest part of the North American continent, (Texas, California, Arizona), are all traditionally dry areas. It’s really not a market maker if New Mexico is dry in mid-July, so its impact on commodity prices is limited.

The weather feature which has been driving the summer grain markets since late June has been the excess rainfall in the eastern half of North America. There’s tremendous variability in crop health in wet fields, and for the past four weeks, corn, soybean, and soft wheat prices have been reacting to a potential reduction in 2015 production due to flooding and the plant health issues which accompany excess moisture. Effectively, the market which we have been operating in since mid-June has been the summer weather rally; it’s just been a rain-based rally as opposed to a drought-based rally.

Six weeks ago, the spec funds were carrying very large short positions in the CME corn and soybean futures. As soil moisture became a larger story, we saw the spec’s buying and the farmer selling in a shift which took the fund positions to near-record longs. Such a significant shift in positions propelled grain values substantially higher, but this rally has likely reached its apex.

The crop variability resulting from this summer’s moisture makes it extremely difficult to estimate an average yield to use to build the production side of the 2015 grain supply and demand model. The rally likely pauses here while we wait for the August crop tours to start making more educated estimates about potential yield. Once the market gets to see Pro Farmer, and some of the other’s yield projections based on kernel counting on corncobs and pod counts on soybeans, the market will have reason to make another adjustment based on a revised production model.

A pause in the rally is a good place to take stock of the prices and get caught up on your marketing plan before the next shift starts. Fundamentally grain is not scarce. Regardless of what happens in the field in the next two months, corn and soybean ending stocks at the conclusion of the 2014 crop marketing year will be larger than at any point in the past few years. A potentially smaller 2015 crop is useful to corn and soybean growers as it will raise prices, but there’s a limit to how far this rally can run when it has to carry such a large inventory of stocks with it. If your concern is that adequate sunshine and heat can enable crops to turn all of this rainfall into yield, then making sales prior to the yield estimates being confirmed is the best decision at this point.