In a world where we are used to watching the commodity futures prices do some confounding things, it’s nice to know that there are a few trends that you can usually count on. One of those is the way in which the wheat futures tend to rally right around the time that the market needs to encourage us to plant winter wheat again, and the fall of 2013 has been no exception.

I’ve often compared the wheat market to a flirty girl in the way that we as producers get tricked into planting acres. It’s not uncommon that by the end of harvest, wheat producers in at least some regions are so fed up with sprouts, fusarium, low proteins, or some other quality failure, that they are ready to swear off ever planting wheat again, and then in late September to early October the prices on new crop start to rally, and we are all too willing to rush out to the field with the seed drills chasing the lure of new crop pricing.

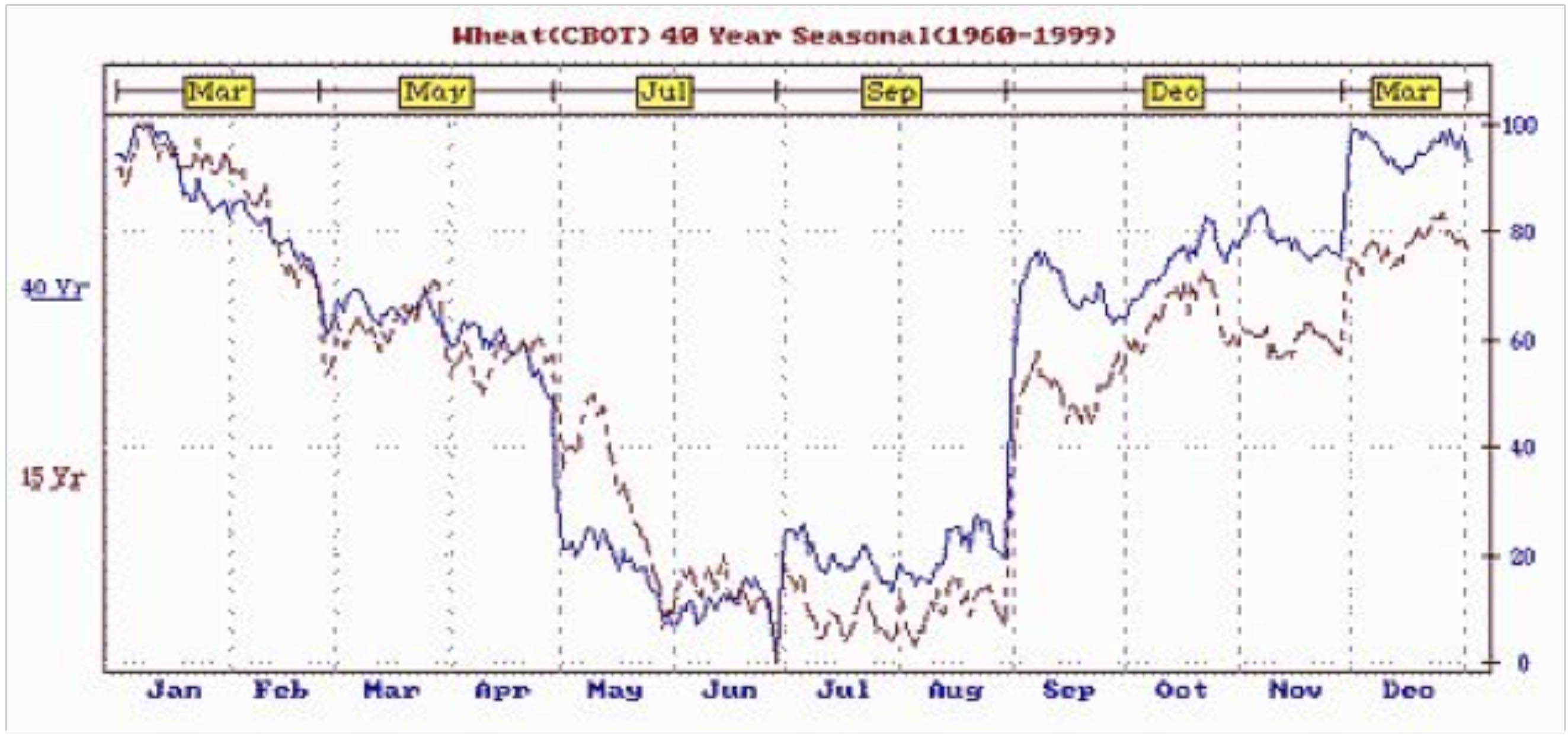

The chart below aggregates 40 years of seasonal swings in the CBOT wheat futures. The data is a bit old, but the stock market collapse of the fall of 2008, and the drought distorted market of 2012 camouflaged the trend in the past couple of years. As we return to more ample grain stocks in 2013, we should expect the market to return to a more normal posture.

There are really two opportunities for producers to take advantage of in the current rally in wheat values. The first is that if you’ve held wheat since harvest and now you’re wrestling with how to create enough storage space to put the big corn crop away, the market place has created a great opportunity to cash in on the gains with wheat values and then have the wheat bins empty in time to re-use them for corn storage this fall.

The second and perhaps more widely useful opportunity is to start marketing some 2014 crop wheat on this fall price rally. Basis values for 2014 crop have remained relatively firm in recent weeks, in part due to the fact that the market is unclear on exactly how many acres of winter wheat growers intend to plant, and whether or not the wet conditions of late are interfering with producers getting those acres sown. If the October rally is the market’s way of trying to buy acres, it’s not a bad idea to sell them some. Being 25% sold on 2014 crop wheat on the fall price rally is a very safe position, and, barring a 2014 drought, will look like a really good choice by the time that the crop is ready to be harvested.