There is an enormous industry of people who analyze the commodity markets and use this information to build positions in the marketplace, so in order to get a significant movement in grain prices, a report has to bring something to light which very few had expected. Certainly the January 11, USDA Quarterly Stocks Report did not fail to accomplish this. The Chicago Board of Trade old crop corn futures have rallied as much as $0.50 per bushel in the first few sessions following the release of the January report, so what is it about the January report which caught the market so off guard?

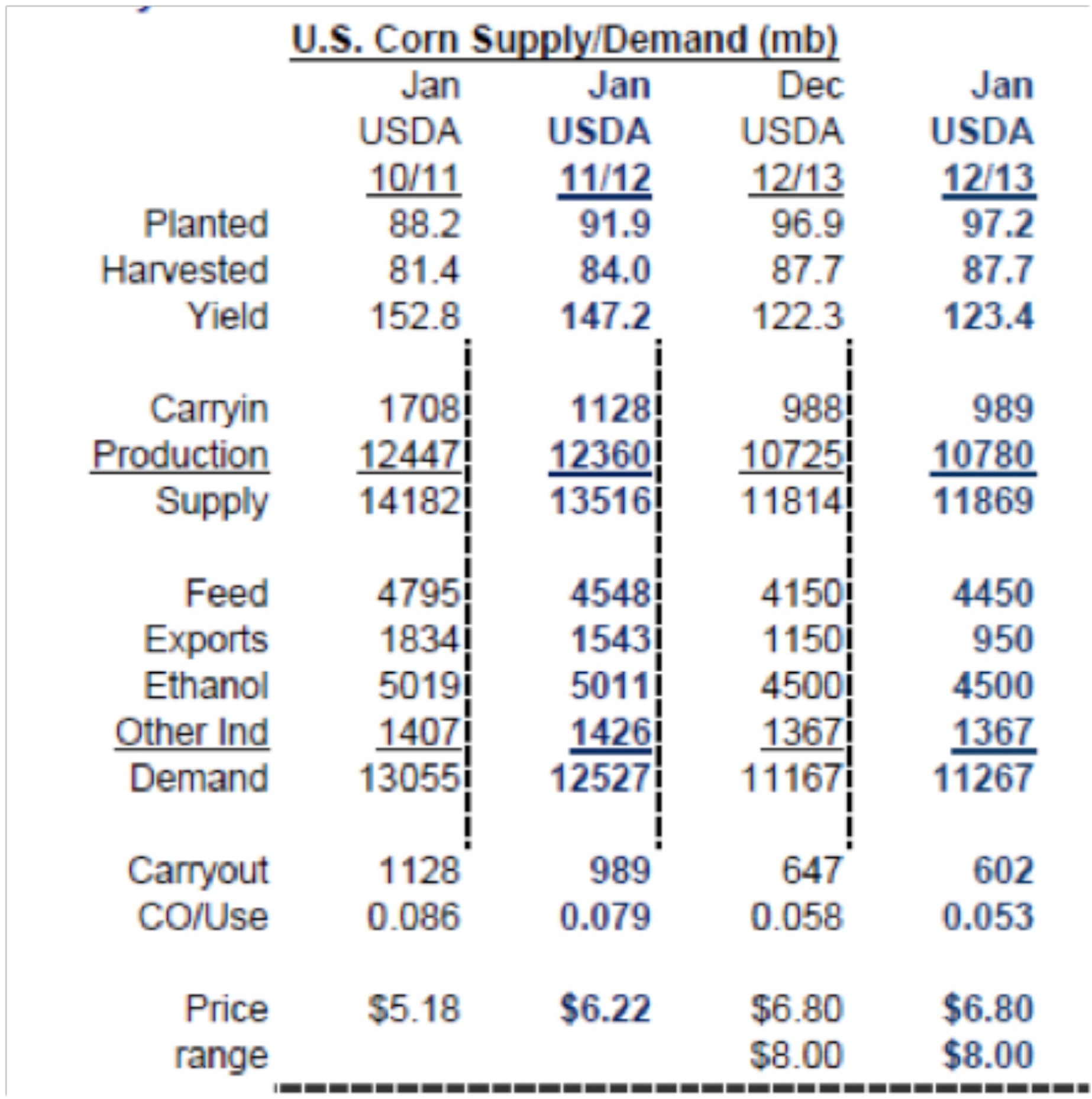

The chart below shows four columns: the first two are the January USDA corn stocks from the previous two years (this is useful because it puts this year’s estimates into perspective); the two columns to the right are last month’s and last week’s USDA estimates.

Leading into the report, there were two well-known facts which were dragging corn values lower. The first is that export sales of corn are below the typical pace and below the previous estimates. It’s easy to count ships leaving the continent, and everybody knew that we were not getting rid of corn at the speed previously expected. Ethanol production is also fairly easy to measure, and although consistent with the trade’s estimates, we’re not manufacturing bio-fuel at the pace which the industry did a year ago. Based on these two factors, the market’s general bias leading into the report was to lower the usage of corn, which would result in an increase in ending stocks.

The surprise in the USDA report, which has lead to the big market correction, is the substantial increase in the estimate of the amount of corn being fed. Last Friday, the United States Department of Agriculture raised its estimate of the amount of corn being used in livestock feed by 8 million bushels over last year’s consumption and 300 million bushels over last month’s guess. To put that in perspective, the amount of their “adjustment” is about the size of Ontario’s annual corn production, and due to the size of that adjustment, the market reacted accordingly.

Tightening up old crop corn stocks won’t do much for 2013 prices, which are still dominated by the sheer size of the planting intentions (until we reach the time where growing conditions start to matter), but it has created a new seller’s market for old crop stocks still in the grower’s bin. The questions that farmers have to wrestle with now are: 1) Is there really that much more livestock around? And 2) are they feeding more corn, or are wheat and other feed grains eating into corn demand?

There have been a lot of conversations over the years regarding whether or not the USDA reports are accurate, but ultimately that doesn’t matter. This is the information which the market is going to trade until something new comes along. The shift in corn futures values in the first few days following the report, are not the start of a new trajectory, but an adjustment to reflect the new supply and demand situation. The decision which corn producers need to make is whether they make some sales based on this information, or stand in to see what surprise the next USDA report might bring.