The past seven months have been a really interesting period for the winter wheat business in the Great Lakes Basin. An extremely wet planting period last fall cut into the seeded acreage, the long tough winter resulted in extremely high levels of winterkill, and, in the midst of all of our weather-related challenges at home, political turmoil in the Ukraine (one of the largest winter wheat producing regions in the world), have all kept the pace of farmer selling slow, and prices firm. The reality, however, is that the market’s support is not the result of enormous demand, but rather a thinly traded market.

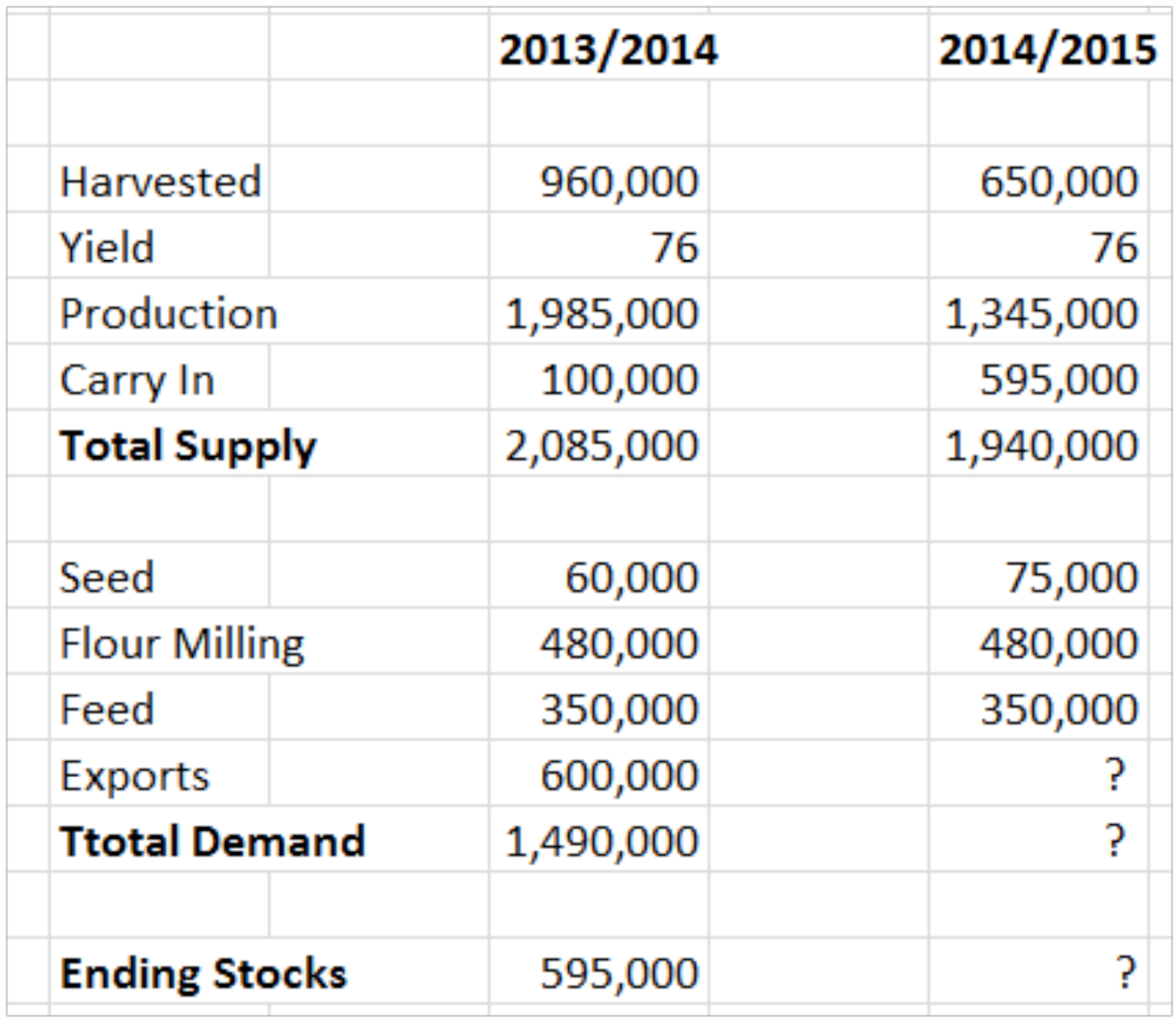

The chart below is a rough supply and demand estimate for the Ontario winter wheat market; it is grotesquely over simplified, but illustrates the situation in the Ontario wheat market. Even with a substantial drop in Ontario wheat production this year, the unused carry forward of last year’s crop will create a total supply of nearly 2.0 million tonnes. (Within 10% of last year’s supply.) The domestic flour milling industry only consumes about 25% of Ontario’s soft red wheat crop, so the balance of it needs to find a spot either in the export market, (where it is tied to world wheat prices), or in the feed market, (where its value is tied closely to corn).

In a purely mathematical world, it would seem that the price of wheat in Ontario needs to come snapping into line with ether the price of corn, where it would be fed, or to the world soft wheat prices, which are also at a substantial discount to today’s forward contract values.

The reason that prices on 2014 crop wheat have stayed firm is because our domestic milling market demands quality. It is not enough that they have wheat; they require wheat that meets very specific quality thresholds in things like sprouts, vomitoxin levels, protein, and gluten strength. While we are all reasonably confident that the 2014 crop supply of wheat will be sufficient to exceed demand, it is far too early to have any assurance that the new crop’s quality meets the market’s expectations. The risk premiums which are built into the new crop soft red prices right now have nothing to do with whether or not we will have enough supply, but rather whether or not the supply will have enough quality.

The one exception to the general winter wheat market is hard red winter wheat. The class of wheat is extremely scarce relative to demand, and there are no signs that the situation will improve in the coming crop year. Ontario’s planted hard red winter wheat acreage has declined consistently over the past few years, and the major production region for this class of wheat in Kansas and Oklahoma has been ravaged by drought this spring, resulting in a forecasted yield reduction of 20%. While we appear to be adequately supplied with soft red winter, hard red winter is quite a different story.

Producers who are holding off on marketing 2014 crop wheat are purely placing a bet on wheat quality. (Ideally, that somebody else has the quality problem.) A smaller crop this year will do a great deal of long term good for wheat prices because it will draw down the burdensome carryovers which have swamped the wheat market for the past several years. But reduced 2014 crop production on its own can’t carry domestic prices higher.