Soybean prices have been extremely firm over the past three years, due largely to the fact that world demand for the oilseed has been growing faster than the North American supply. In both 2012 and 2013, ending stocks for soybeans in our market were essentially zero, but record acres harvested in 2014 with record average yields have ended the market built upon scarcity. However, with 2014’s massive crop size, and a market shifting to a mentality of abundance, how do producers optimize their marketing potential moving forward?

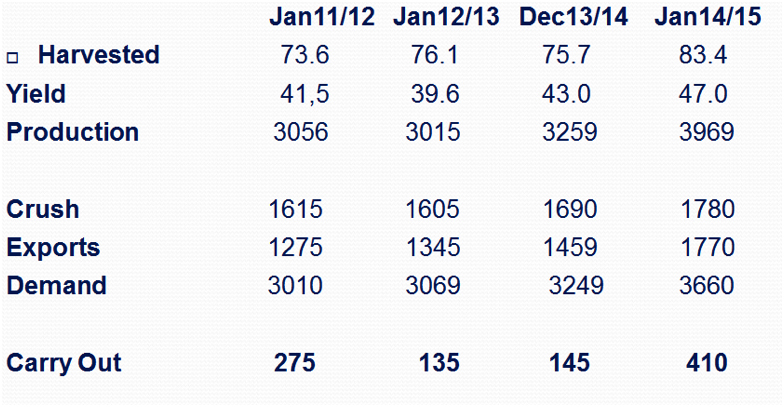

At the conclusion of both the 2012 and 2013 crop marketing year, (which ended five months ago in September of 2014), North America was essentially out of soybeans. While 135 or 145 million bushels sounds like a big number, it only represents 3% to 4% of the available supply. Similar to having 300 or 400 bushels left in a 10,000 bushel bin, it’s fair to say that on both years North America essentially ran out of soybeans to sell. That lack of sales capacity from producers held marketers high until we moved past the 2014 harvest. With the 2014 crop carry out currently forecast at more than three and a half times the previous year’s ending stocks, buyers are far less concerned about supply, and prices continue to ease.

Over supplied markets have a very lazy posture. When stocks were tight over the past three years, there is always strong spot demand as end-users try to cover their immediate needs, but when supplies are large, the nearby delivery bids tend to get weaker relative to the forward prices, since seller’s need to move inventory or create cash flow outweighs the demand side’s need for product. This collapse in the soybean “spreads” has been extremely obvious over the first few weeks of 2015. On January 8, 2015 the price spread between spot ship 2014 crop soybeans and harvest delivery 2015 crop soybeans was $0.65 per bushel in Canadian funds delivered to an Ontario port. On January 19, that spread had collapsed to $0.33 cents. The spread did not move in because new crop prospects improved, but rather because the old crop appetite is quenched.

In a well-supplied market, there are a couple of hard and fast sales rules. The first is that the highest values are further out the calendar. In trade lingo, it is referred to as a “carry,” but in practical terms it simply means that the near terms supply is well covered but the market will pay more in the forward delivery times in order to offset the risk of time. For example, July soybeans are worth more than February soybeans simply because something might happen in the market between now and July. There is a premium included in the forward sale value because the seller is alleviating the buyer’s price risk. With so much soybean production in the world in 2014-2015, selling that time risk is going to become an important portion of the grower’s profit margin.

Most producers have an expectation about when they plan on moving their crop on to the market. Regardless of whether it is at harvest time, or perhaps mid-summer, the marketing discipline in a year such as 2014-2015 will be in not allowing the time line to collapse to the point that the crop is being sold and shipped at the same time. While that system worked reasonably well over the previous few years when inventories were very tight, this year’s situation is different, and calls for a different marketing strategy. Capturing the time premiums for carry is critical. Avoid selling in the spot market, avoid rolling basis contracts, (because they lock your opportunity in the nearby time slot which has the least upside potential), and aim to make sales four to 10 months prior to the delivery period.