In spite of all of the recent discouraging news about the size of the oilseed production in other parts of the world, there is still some encouraging things to be found if you know where to look for them.

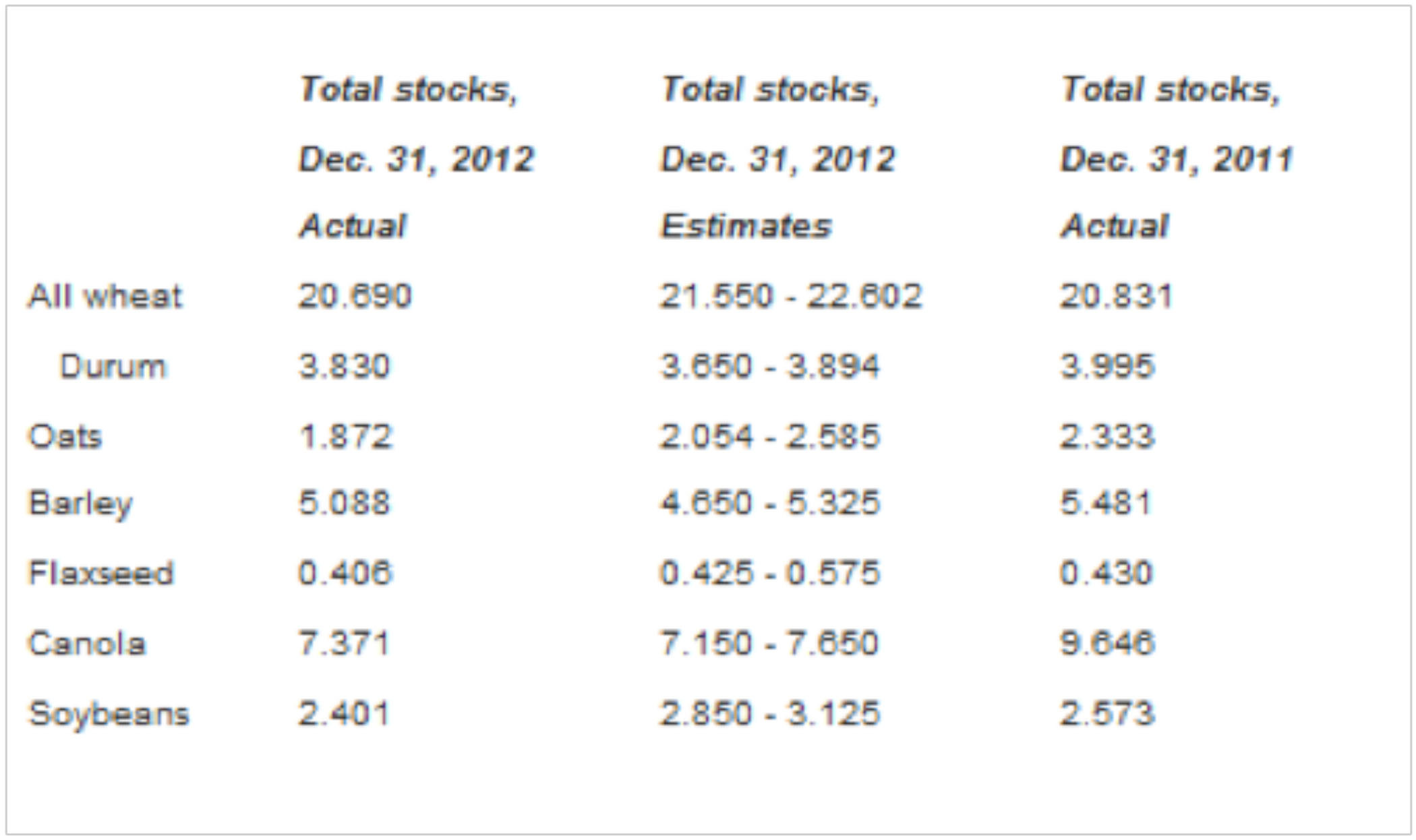

On Feb. 5, Statistics Canada released their estimates of the grain stocks in Canada as of Dec. 31, 2012. The chart below shows Canadian grain stocks, (in million metric tonnes), and compares them to the previous year’s stocks and the trade’s estimates prior to the report being made public.

While wheat stocks are slightly lower than the industry might have expected, the inventory is largely in line with the levels of a year ago, and are within 10% of the anticipated levels, so there was very little in this report to make the wheat market react.

Soybeans stocks in Canada are both lower than expected and lower than last year. Since the 2.4 million tonnes of Canadian soybeans represents such a small percentage of the 130 million tonnes of soybeans which will be harvested in Brazil and Argentina over the next eight weeks, it would be naive to assume that our tight inventory situation could impact futures values, but it may encourage domestic crushers to be a little more generous with basis in order to make certain that they can continue to have beans flowing into their facilities.

The sharp decline in oat stocks is startling, with the inventory reduced by 20% from last year. Both of the farmers in Ontario who grow oats must be delighted with this news.

The significant deviation in the Statistics Canada grain stocks report that has the capacity to drive the market is canola inventory. The size of the canola inventory has declined every year for the past three years, and now sits at its lowest level since 2006. Domestic canola crush demand has continued to expand as the inventories have shrunken, which makes watching the situation interesting now.

Canada’s total canola inventory has declined by 23.6% between December 31, 2011 and December 31, 2012. To put that in perspective, the total decline in U.S. corn production between 2011 and 2012 due to last summer’s drought was the same 23%.

The WCE canola futures contract has reacted as one might expect to the current inventory situation. Over the course of the past month, the board values have continued to rally and are pushing back towards the “life of the contract” highs which were achieved in the driest days of this past summer. The futures values will remain in an inverse (with the nearest delivery month at the highest value), as the market continues to try to pull stocks out in order to meet demand, so it creates an opportunity for farmers to roll basis contracts forward and pick up a positive spread.

The most important factor for Ontario canola growers to monitor as they are looking for opportunities in the new crop market is that with so much domestic demand for canola seed, the market will be fixated on 2013 planting intentions and planting progress. With stocks already tight, the canola industry could have trouble if production doesn’t rise back up in 2013. If you are considering making marketing decisions (or planting decisions) on canola, the key piece of information to monitor is planting intentions for this year’s crop. Unless the planted acreage starts to rise, there is no fundamental reason for values to be able to break lower relative to other crops.