There is an old saying in the grain business that “short crops have long tails.” Due to the summertime drought of 2012, this past year’s crop was definitely “short,” but the pace of sales over the past four months has certainly allowed that crop to grow a pretty substantial tail.

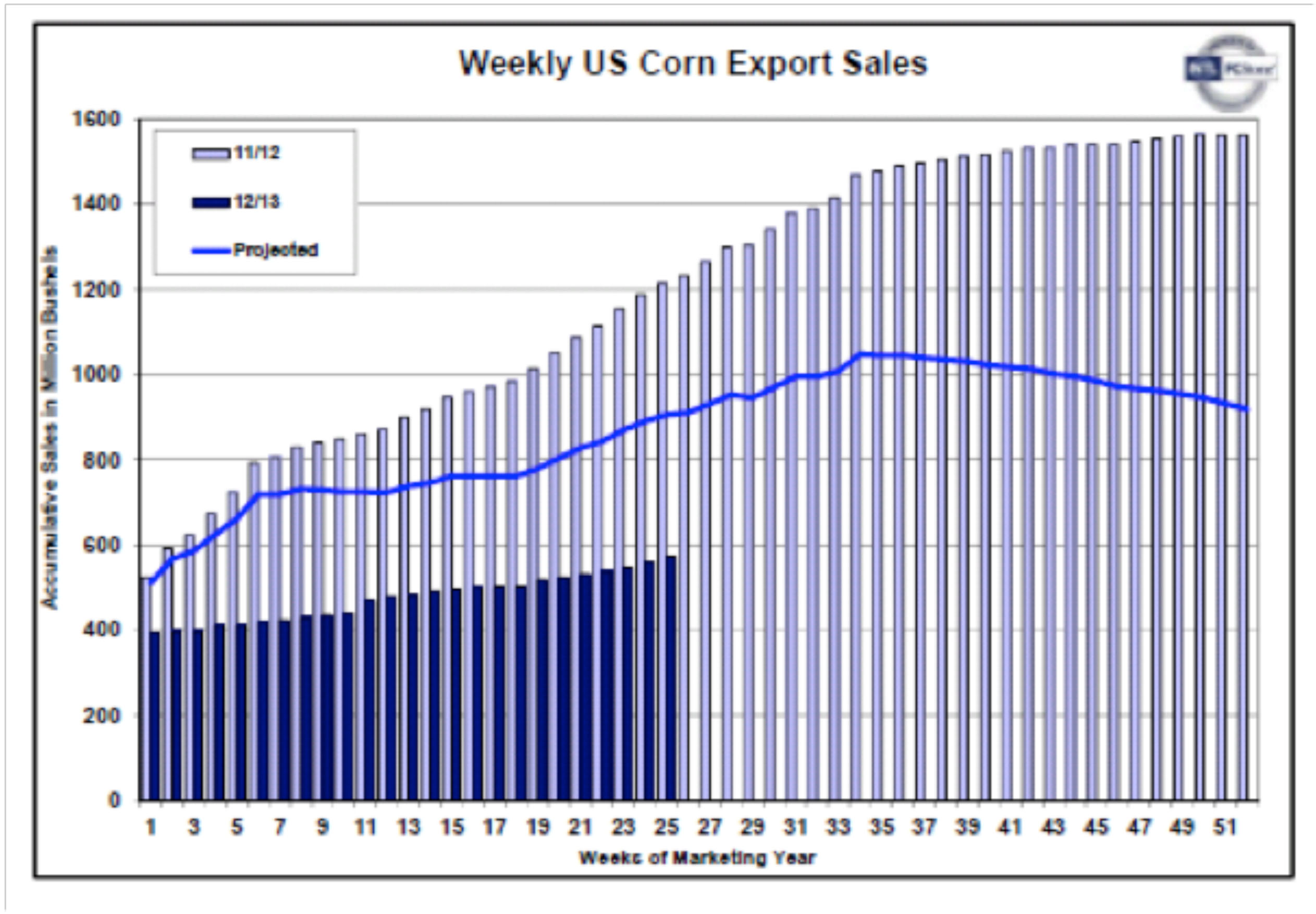

The chart below provides a very concise illustration of the situation which is developing with the corn inventories. The light blue bars represent the export sales pace of U.S. corn for the 2011 crop year (which extends out through the spring and summer of 2012). The blue line graph is the predicted pace of U.S. export sales which the USDA has been using for the corn supply and demand models, and the dark blue bars are the actual export sales pace for the 2012 U.S. corn crop. As you can see, the actual pace of sales is lagging substantially below the trade’s expectation.

The slower pace of export sales is really the perfect storm of human nature. The first factor is that growers know that grain is scarce, and they are more inclined than ever to hoard inventory, so the overall pace of sales (which become the supply which is available for export), is reduced. There is also no cure for high prices better than high prices. Buyers of corn are well incentivized to search for alternatives or ration their demand when prices are high. Both of these factors had to influence the market because of the size of the 2012 corn crop. The question is whether the marketplace has these influences in balance, or whether we’re going to have to shift posture slightly in order to get the supply/demand balance right.

Over the previous 10 weeks, the United States has averaged 194,300 tones of export sales of corn per week. In order to reach the USDA’s estimate for corn exports for the 2012 crop year, they need to be averaging 308,000 tonnes per week. Ultimately, if the product doesn’t leave the market, it will appear as larger ending stocks at the conclusion of the crop year, and the stocks to use ratio will ease. This larger carry out from a small crop is the phenomenon known as a “long tail.”

To date, the potentially larger supply of corn at the end of the summer is having only a theoretical impact on cash prices. Although the corn inventories are growing due to the lack of movement, the producer is not a very willing seller, so the price for immediate shipping hasn’t weakened as much as it could have. The continually growing inverse in the corn futures market (where futures are worth less the further forward one goes), is a confirmation that the market is becoming less concerned about being able to buy corn in July and September than they are worried about being able to buy corn now.

It is irresponsible to make too many predictions about the summertime market before we get the crop planted (there is a lot of weather between now and harvest), but we do know that the ending stocks of last year’s corn crop are growing every day, and that the 2012 corn crop won’t end up as scarce as it was when it started.