38

The Business of

Ontario Agriculture

Better Farming

December 2016

BETTER

BUSINESS

D

ecember is a good time to

plan. For years, you have

considered the advantages of

commodity crop marketing. You’re

interested, but then you start to

research and your eyes start to glaze

over when you encounter terms like

futures, margin, hedge, bull markets,

and bear markets. Don’t let those

specialized terms intimidate you.

In the end, commodity marketing

is about understanding supply and

demand. When there is lots of supply,

commodity prices are typically low.

When there is no supply, commodity

prices are typically high. Traditional-

ly, supply is higher at harvest and so

the price goes down.

But the psychology of fear has a

large part to play as well. If there is a

drought or flood during the spring or

summer, people in the industry may

begin to worry that there will not be

enough of the commodity when

harvest comes. So, organizations such

as grain elevators, food suppliers, and

energy suppliers enter into agree-

ments with farmers ahead of time to

guarantee their supply at harvest.

The majority of farmers sell their

crops at harvest. That’s how crops

have been marketed for hundreds of

years. But, most years, harvest time is

when the price is at its lowest.

For most farmers, commodity

marketing is a major change in habits.

There are, of course, risks involved

with pre-selling your corn or soy-

beans. For example, what if the price

of grain is actually higher at harvest

than when you book? Will this mean

you will lose money? Historically this

has happened – but the law of

averages is on your side.

What if you pre-sell and at harvest

you don’t have enough bushels to

meet your contracts? There are ways

to reduce this risk as well. As outlined

below, if you don’t commit 100 per

cent of your crop you should be able

to mitigate this risk. What is the worst

crop you ever had? For peace of

mind, don’t commit more than that

amount of bushels in a forward or

futures contract.

First, you need to gain at least a

basic understanding of commodity

marketing. The price of corn and

soybeans is influenced by many

factors: weather and politics – both in

our own province and country as well

as internationally (United States,

Brazil, Russia, etc.), energy costs, and

the Canadian dollar, to name just a

few.

The easiest way to start to build an

understanding of these factors is to

consume specialized information.

You can select from a number of

newsletters and services to subscribe

to. And these resources are usually

worth their subscription fee since

they save you time in researching the

information. Consider the investment

this way: is it worth the $500 sub-

scription fee if your bottom line is

increased by $10,000 each year?

Before you move onto the next

step, you should determine your cost

of production. There are many tools

available from commodity risk

Will 2017 be the year you start

commodity marketing your grain?

by DENISE FAGUY

Don’t be intimidated – becoming familiar with the markets may not be as overwhelming as you think.

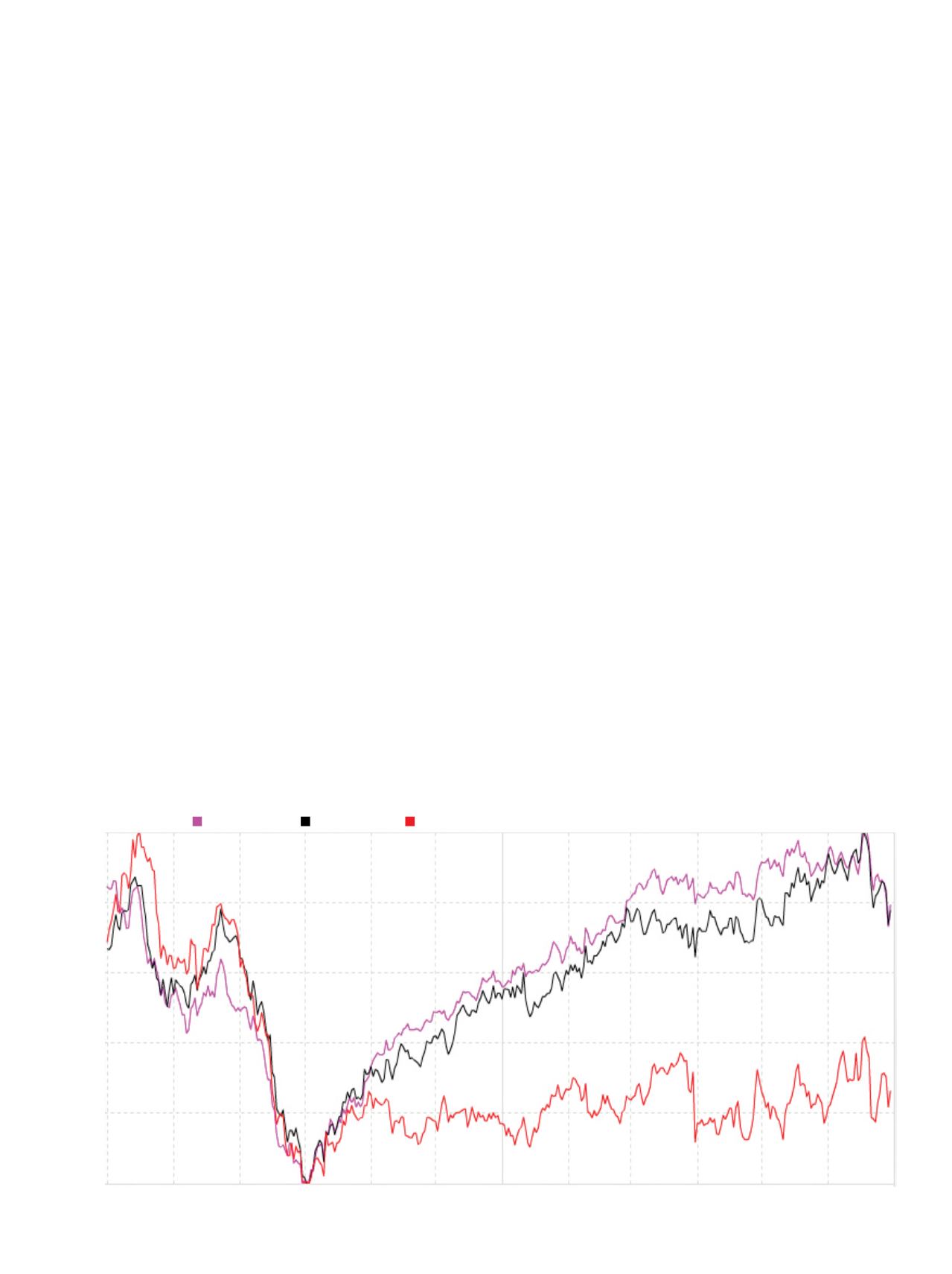

2015 Aug

Sept

Oct

Nov

Dec

2016

Feb

Mar

Apr

May

June

100

80

60

40

20

0

Historical patterns of corn prices

Percentage of seasonal pattern

Jun 30, 2016:

30-Year:

79.31

5-Year:

26.36

15-Year: 77.83

Source: Moore Research Center, Inc.