Better pork

August 2016

37

MOE’S

MARkET

MINUTE

A

ccording to the United States

Department of Agriculture,

China’s pork import growth

could last into 2017. U.S. pork ex-

ports to China/Hong Kong doubled

in April to 74 million pounds. Chi-

na’s own pork producers continue to

struggle to meet domestic demand as

environmental restrictions continue

to hamper China’s pork industry

expansion. Chinese prices for feeder

pigs and live slaughter pigs do not

appear to have peaked. Despite the

rally of the past 15 months, the price

of Chinese 40-pound feeder pigs

began June at the equivalent of $145,

more than twice that of a year ago,

according to official Chinese data.

The price of fattened hogs, at about

$143 per hundredweight, was up by

some 35 per cent year on year.

Strong Chinese demand has

helped support CME U.S. lean hog

futures with the 2016 August summer

month trading to new highs above

$90/cwt on June 15, 2016. This June

price was up by 10.7 per cent over

the previous month on speculation

that export volumes will continue to

gain as China/Hong Kong expand

their purchases of U.S. pork. USDA

forecasts that China’s import of U.S.

pork will be up 7.4 per cent in the

second half of 2016. Futures are

starting to price in a very explosive

export demand outlook, as they

did in 2004 when October futures

traded even higher than the summer

seasonal highs.

The good news for hog futures

is that the prospect of a continued

shortfall in Chinese pork produc-

tion implies strong import demand

is likely to persist, at least through

this year. If it’s better than expected

we could see a further reduction in

domestic disappearance of one to

two per cent. The overall trend also

suggests deferred hog futures that

normally fall in the winter may not

fall as much on increased supplies.

A relatively low U.S. dollar is a

tailwind for U.S. pork exports, making

these exports globally competitive,

vis-a-vis the European Union. In

the United States., pork is competi-

tively priced for the grilling season,

while beef remains high versus other

competing meats. This recent rally in

hog futures could be demand driven

as suggested by the high hog slaughter

numbers, and any supply-side issues

will only amplify the better-than-ex-

pected domestic and export demand.

U.S. pork exports will remain a

critical driver for hog futures for the

remainder of 2016 and 2017. The

hog market is holding a much larger

premium to the cash than normal

and may have already priced in

much stronger-than-normal China

demand near-term. In mid-June,

August hog futures rose to new

contract highs — a convincing sign

of bullish confidence regarding the

potential for higher prices over the

short term. The June heat wave

in the United States could have

dropped hog weights faster than

expected and spark another rally

higher. Tightening hog numbers are

supporting cash hogs, as are a num-

ber of other indicators. Keep an eye

on the cut-out, as it needs to continue

rising to support higher hog futures.

Cash is king!

BP

Maurizio “Moe” Agostino is chief commodity strate-

gist with

Farms.comRisk Management. Abhinesh

Gopal is a commodity research analyst with Farms.

com Risk Management.

Risk Management is a member of the

Farms.comgroup of companies. Visit RiskManagement.Farms.

com for more information.

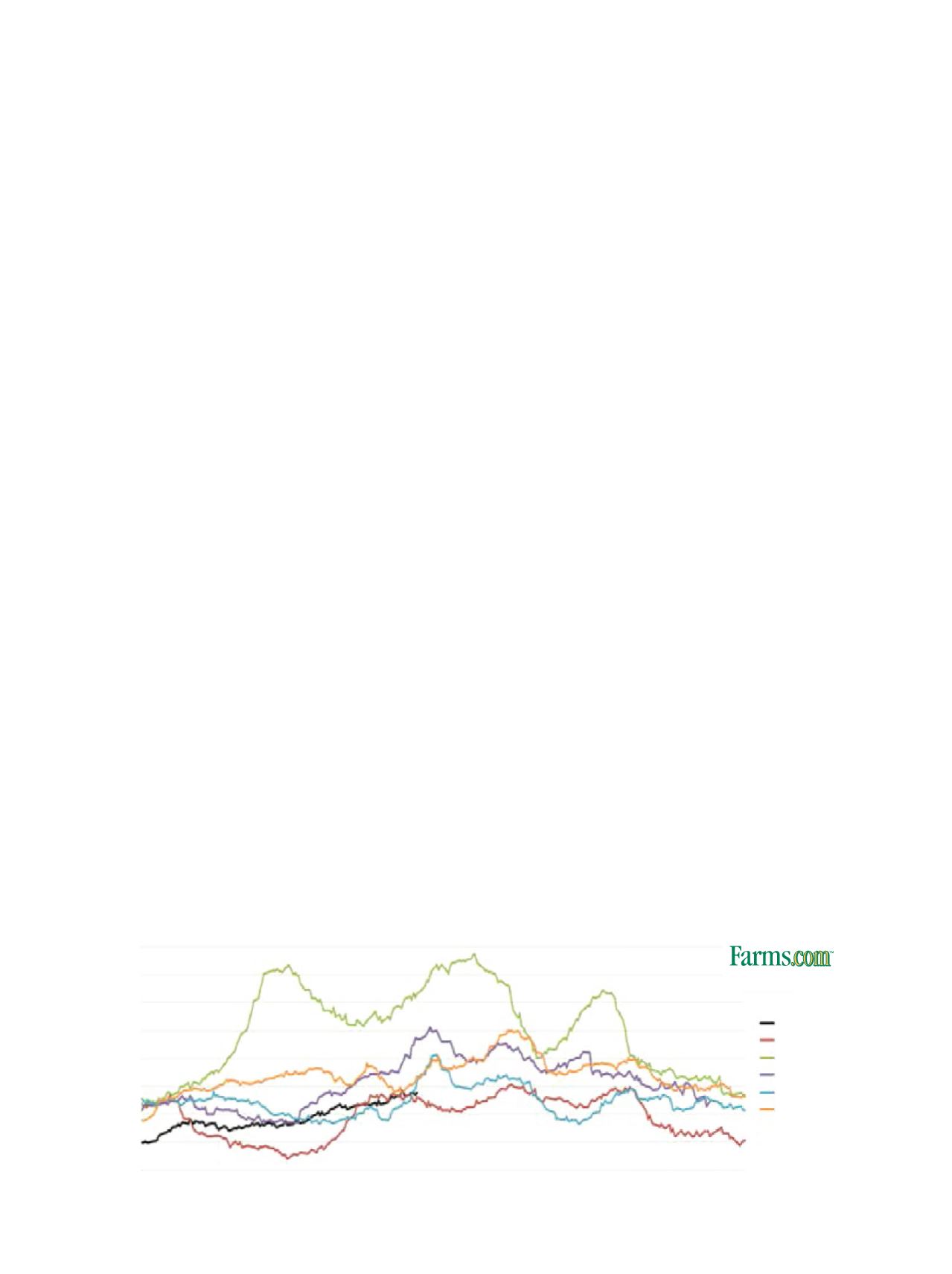

Chinese import growth shapes hog futures

Expect strong market demand for pork to continue well into the fall, predict

Farms.commarket analysts.

by MOE AGOSTINO and ABHINESH GOPAL

60

70

80

90

110

120

130

140

100

PORK DAILY CUT-OUT 2011-2016

2016

2015

2014

2013

2012

2011

04-Jan -

11-Jan -

18-Jan -

25-Jan -

01-Feb -

08-Feb -

15-Feb -

22-Feb -

29-Feb -

07-Mar -

14-Mar -

21-Mar -

28-Mar -

04-Apr -

11-Apr -

18-Apr -

25-Apr -

02-May -

09-May -

16-May -

23-May -

30-May -

06-Jun -

13-Jun -

20-Jun -

27-Jun -

04-Jul -

11-Jul -

08-Jul -

25-Jul -

01-Aug -

08-Aug -

15-Aug -

22-Aug -

29-Aug -

05-Sep -

22-Sep -

19-Sep -

26-Sep -

03-Oct -

10-Oct -

17-Oct -

24-Oct -

31-Oct -

07-Nov -

14-Nov -

21-Nov -

28-Nov -

05-Dec -

12-Dec -

19-Dec -

26-Dec -

Source: USDA