Better Farming

November 2016

FarmNews First >

BetterFarming.com55

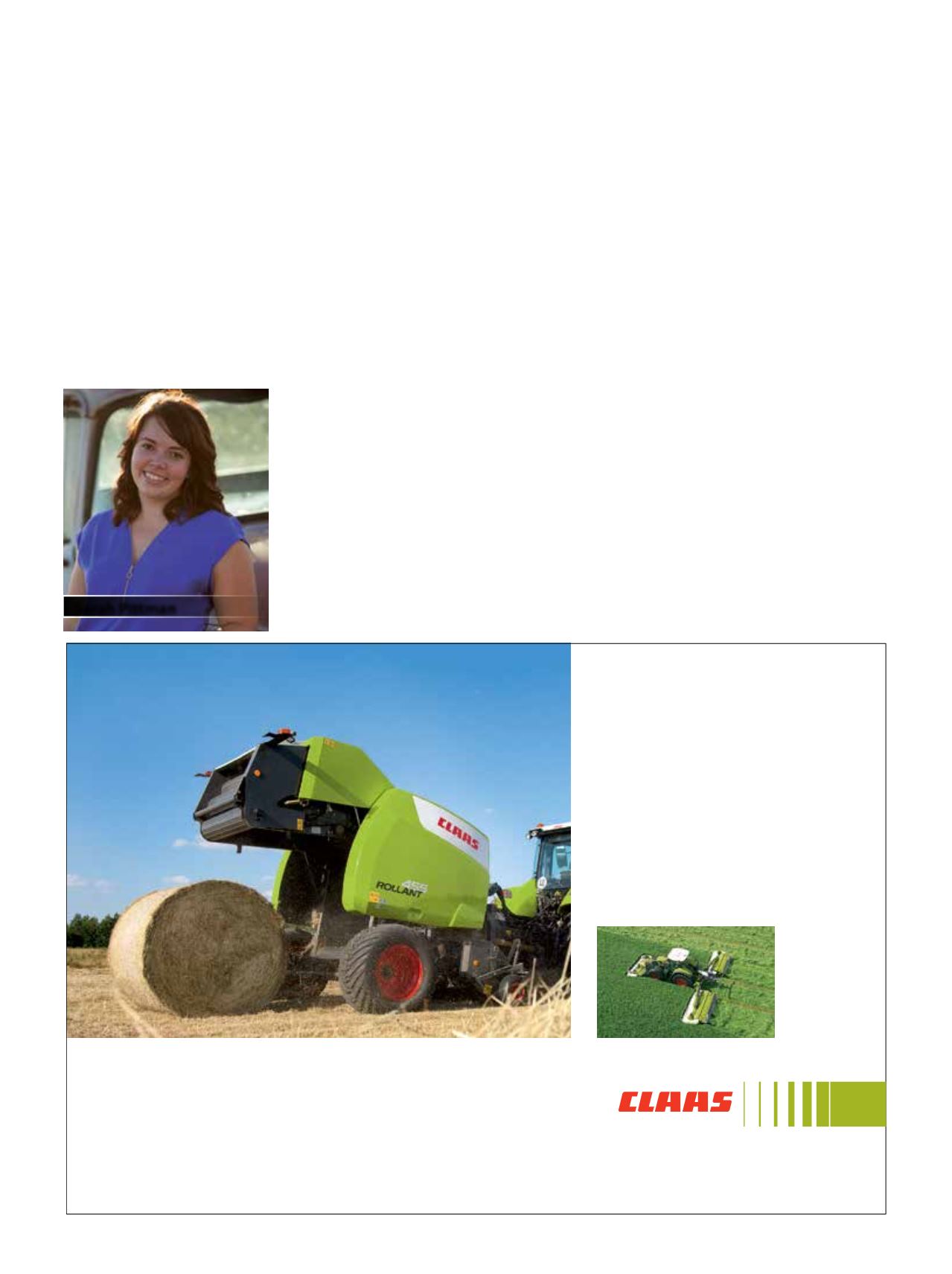

©2016 CLAAS of America Inc. Subject to credit approval through CLAAS Financial Services. See participating dealer for details and great financing rates. Product and specifications subject to change without notice. claas.com All-around powerful. Get first class forage harvesting with the complete line of mowers, rakes, tedders and balers from CLAAS. Reliable technology, seamless operation and robust machinery makes for outstanding performance. Ask your dealer about the complete line of CLAAS balers and hay tools. Special financing available through CLAAS Financial Services October 1-December 31, 2016. Connect Equipment Chepstow 519-366-2325 DeBoer’s Farm Equipment Elora 519-846-5388 Elliott’s Farm Equipment Pembroke 613-638-5372 G.J.’s Farm Equipment Burgessville 519-424-9374 Ken Brownlee & Sons Equipment Earlton 705-563-2212 Reis Equipment Centres Carp 613-836-3033 Winchester 613-774-2273 St. Isidore 613-527-1501 Sunova Implement Lakeside 519-349-2075THE

HILL

National farmdebt levels

Statistics Canada has released data on the 2015 farm debt levels and the Canada West Foundation is

raising concerns about the implications of these figures.

by BARRY WILSON

E

ven for veteran agriculture

watchers, this year’s Statistics

Canada tally of 2015 farm debt

levels was (pick your cliché) eye-pop-

ping, jaw-dropping or just plain

amazing.

After 23 years of annual debt

increases since 1993 that had more

than tripled national farm debt levels

from $23 billion to $84.5 billion in

2014, Canadian farmers piled on

another $7.3 billion in debt in 2015 to

reach $91.8 billion.

It was an 8.6 per cent increase in

the level of debt, the highest one-year

increase in history.

A few years ago when debt was

billions of dollars lower, George

Brinkman, distinguished University

of Guelph professor and agricultural

economist (emeritus), called it a

“ticking time bomb” because:

■

An end to a long run of record-

low interest rates would make the

debt much more difficult and

expensive to service;

■

A decline in commodity prices

or several years of climate-related

crop failure would push many

indebted farmers to the brink,

since debt servicing comes from

cash flow rather than asset value;

and

■

American producers tend

to have lower average debt levels

and therefore less exposure and a

lower cost of production, so they

typically have a competitive

advantage in markets where

Canadian and U.S. agricultural

products compete.

Still, rising farm debt levels have

not been the subject of major focus in

farm sector politics or mainstream

Sarah Pittman