Better Farming

November 2016

FarmNews First >

BetterFarming.com35

MOE’S

MARKET

MINUTE

Are we past the strong headwinds

in the beef industry?

W

ild swings have been the

norm in the beef industry

over the last 10 years, as it

was forced to adjust to severe economic

shocks, such as multiyear droughts,

surging feed prices, etc. Per capita beef

demand is acutely related to the health

of the economy. Owing to a 12-year

trend of declining cattle herd size in

North America, beef prices started

rising - but this situation came to a tip-

ping point in 2014-2015.

Since then, U.S. cattle inventory

rose, from 29 million head in 2014 to

over 31 million head projected for

2017. U.S. beef production is project-

ed to top 26 billion pounds in 2017,

up from just less than 24 billion

pounds in 2014.

But as cattle operators responded

by increasing herd size, they found

that the feedlot/slaughter industry

had already downsized and, as a

result, the price for cattle dropped.

Reports of feedlot liquidations and

bankruptcies have been in the news

recently, highlighting that the

industry has quickly switched from

expansion mode to liquidation

mode. The United States Department

of Agriculture’s (USDA’s) September

2016 Cattle on Feed report showed

that the number of U.S. cattle on feed

(on feedlots with a capacity of 1,000

head or greater) at the start of

September was 10.1 million head.

This total is a one per cent increase

over last year. This year’s calf and

yearling prices are well short of 2015.

Every semi-trailer load of calves

is worth roughly $30,000 less than at

the same time last year. Despite

sharply lower feed costs, projected

cattle operators’ break even prices

continue to decline. Lower cattle and

feed prices are also causing some cat-

tle feeders to add more weight and

look for better pricing opportunities.

Though cattle producers are

getting less for beef, retail prices are

not dropping accordingly. Indeed,

retail prices are expected to remain

high. Foodservice demand, which

over the years has become an

increasingly critical driver for the

meat industry, has been weakening.

The Restaurant Performance Index

has been steadily declining since its

peak in 2014. The customer traffic

index decline has outpaced the

broader index. The number of

customers walking through the door

of American restaurants is lower

than a year ago.

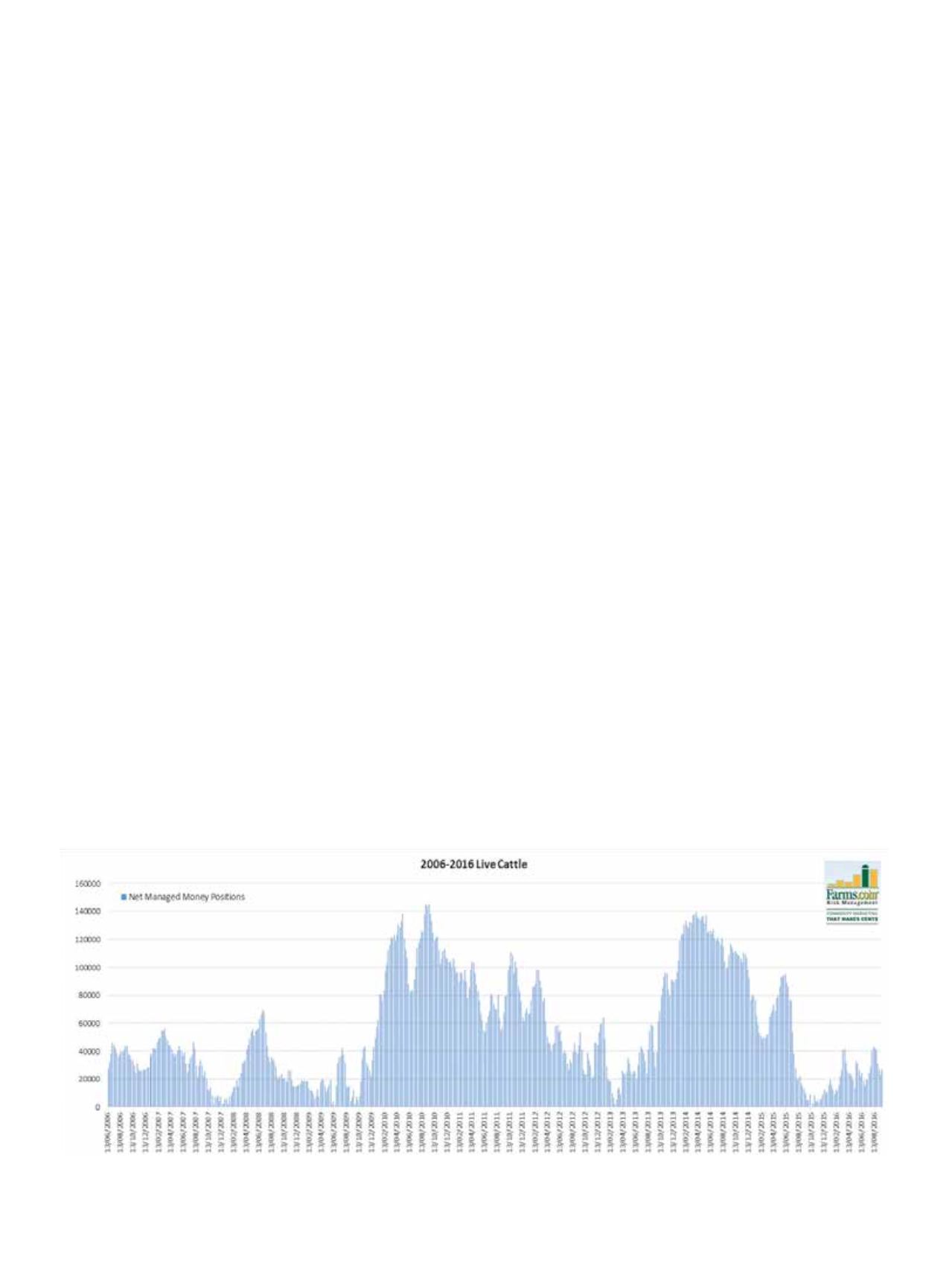

The beef supply glut has caused

managed money funds (speculators)

to stay on the sidelines. Compared to

early June 2015, net buy positions in

feeder cattle at the Chicago com-

modities exchange have dropped by

13,864 contracts and are in negative

territory now. On live cattle, the

reduction in length has been by

71,626 contacts for the same time

period.

Finally some good news for cattle

producers and the North American

beef industry, as China’s Ministry of

by MOE AGOSTINO and ABHINESH GOPAL

Having survived the downside on cattle prices, we may be headed towards an upward move

-

but it may take some time.

Source: U.S. Commodity Futures Trading Commission and

Farms.comRisk Management

Note: the contracts are of 40,000 pounds each.

# of contracts