32

Farm News First >

BetterFarming.comBetter Farming

August 2016

MOE'S

MARKET

MINUTE

Uncertainty in the markets, and weather doubts

By MAURIZIO AGOSTINO AND ABHINESH GOPAL

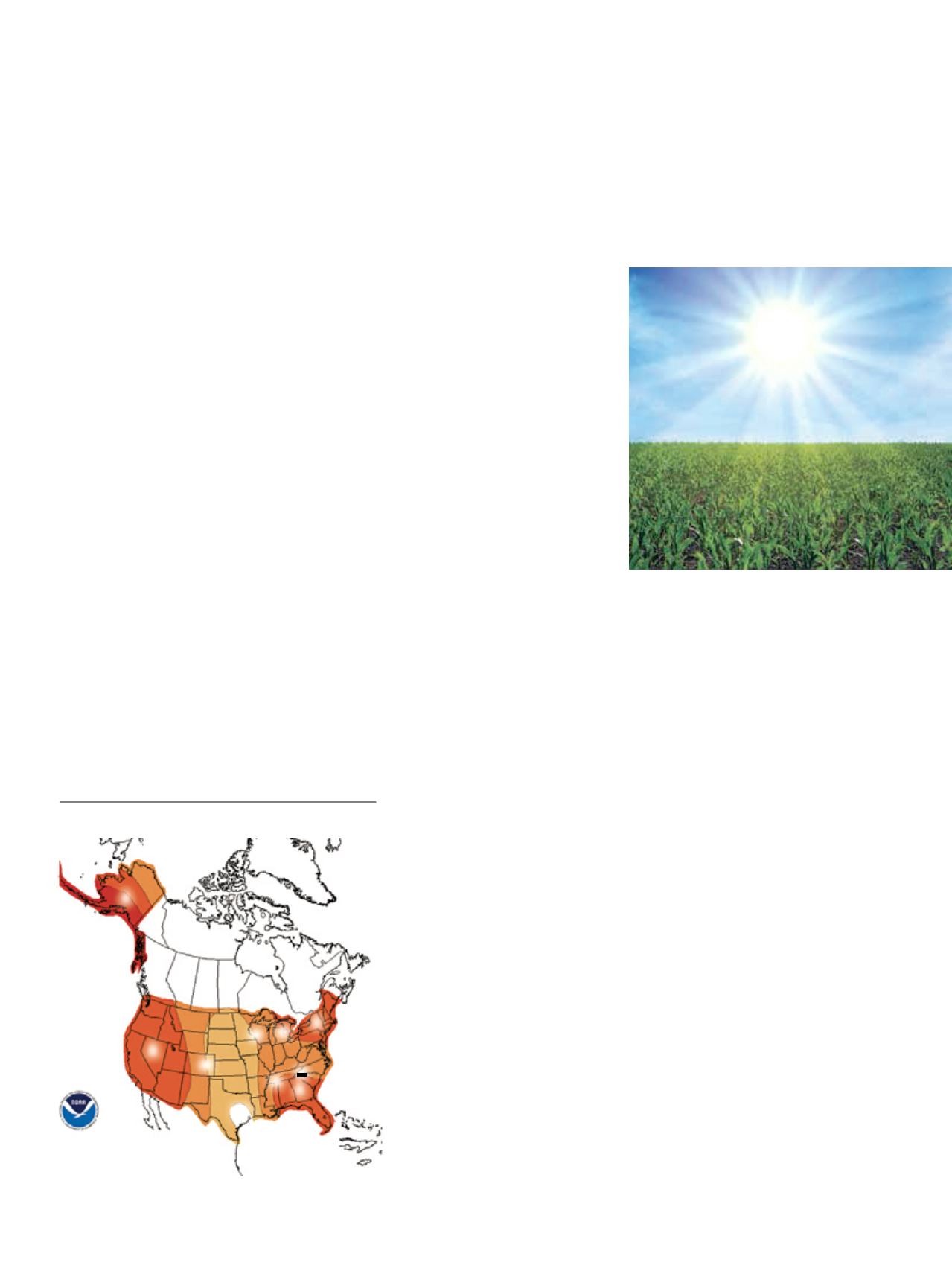

NOAA Outlook for July-August-September 2016

A

50

50

50

40

40

A

A

EC

A

33

60

THREE-MONTH OUTLOOK

TEMPERATURE PROBABILITY

0.5 MONTH LEAD

VALID JAS 2016

MADE 16 JUN 2016

EC MEANS EQUAL

CHANCES FOR A. N. B.

A MEANS ABOVE

N MEANS NORMAL

B MEANS BELOW

Source: NOAA

B

y June, global temperatures had

soared above normal for 30

straight months. According to

National Oceanic and Atmospheric

Administration (NOAA) data, this is

the longest and hottest run since

1880. Following from the recent El

Nino and unprecedented global

warming, we could get yet another

heat record-breaking year in 2016, the

third in a row. As a result, the amount

of ice that melted globally from

March to May of this year was

abnormally high.

In June, NOAA was forecasting

above-normal July temperatures in

the U.S. crop growing areas, and

near- to below-normal rainfall.

Anomalous soil moisture was expect-

ed to significantly influence July

temperatures across the region. In

early June, some parts of Iowa

reported that lawns were drying out

and soil was cracking.

In the latter half of the month,

topsoil moisture shortages became

apparent in parts of the southern and

Agricultural markets prepared for a long, hot summer.

eastern Corn Belt. Some of the most

significant stress on pastures and

summer crops was occurring across

the U.S. southwestern Corn Belt,

including a broad area centered on

northern Missouri, where hot weath-

er accompanied short-term dryness.

By mid-June Missouri farmers had

already noted moisture stress in the

corn leaves, which start to “roll” – a

defence mechanism to soak up more

moisture from the ground. Creeks

and streams were beginning to run

low by mid-June.

Summer arrived in early June. As a

precursor to a very dry month ahead,

the U.S. Southwest began feeling the

heat by mid-June as well. During the

month, some temperatures in the

United States were 20 to 25 per cent

above normal. Many records were

broken in the latter part of the month

when the highest U.S. temperature

recorded was 120 degrees Fahrenheit,

in Glendale, Arizona.

For farmers and ag prices though,

it’s been a mixed bag. In June the

bears were arguing that if

we did not see La Nina and

associated drought condi-

tions by mid-July, U.S. crop

conditions and yields would

not be affected. By the end

of July, corn passes its

critical pollination stage.

For soybeans, it’s another

story as the pollination

stage is later, with an

August crop. In fact, U.S.

Department of Agricul-

ture’s crop conditions were

so good that the risk was for

higher yields if the weather

remains non-threatening.

All we get from a delayed

La Nina could be a hard

dose of winter and snow

this season, in the Northern

United States and Canada.

Added to these weather doubts in

June were global growth uncertainties

connected to the shocking Brexit vote

in Britain and Chinese demand

concerns. It was all pointing to a

commodity price puzzle.

By the end of June, induced by

weather concerns, hedge funds hiked

their net buy (long) positions in

agricultural commodities to the

highest in more than two years. But,

this also set them up to trigger sharp

selling if the U.S. summer weather in

July and August does not materialize.

Managed money raised its net long

position to the highest since May

2014: 957,000 contracts in 13 of the

top ag commodities, according to

CFTC data. All of these factors

combined point to a significantly

over-bought technical situation and

makes the market vulnerable to a

steep sell-off. But one may never

know because, as with weather,

volatility is the new normal.

BF

Maurizio "Moe" Agostino is chief commodity

strategist with

Farms.comRisk Management.

Abhinesh Gopal is a commodity research analyst with

Farms.comRisk Management.

Risk Management is a member of the

Farms.comgroup of companies. Visit RiskManagement.Farms.

com for more information.

GETTY