16

Better Pork

February 2017

EXPORT

MARKETS

Chinese want more of because of

their uses,” says Stordy. “Here, we eat

a lot of bacon, (but

that’s) not exactly

what the Chinese

market wants.“There

has been an increase

of bone-in pork

products exported to

China,” he says. “They

essentially use these

products in their

soups.”

HyLife, says

Vielfaure, knows the

importance of recognizing cultural/

geographic market demands and

supplying the different parts of the

pigs to the right markets. It’s impor-

tant “to sell 100 per cent of the pig,”

he says.

Davidson shares the same thoughts

on securing markets for all products.

“As markets value particular pork

products differently, the key to

maintaining competitiveness is

identification of the market in the

world that will pay the most for each

product,” he says. Therefore, despite

the variation in the dollar value of the

various cuts of pork for the different

export markets, “access

to every market is

highly valued.”

“Accordingly, a

high-priority objective

of Canadian meat

packers and processors

is securing competitive

access conditions for

Canadian meat within

Canada and to every

country in the world.”

Trade opportunities

The hog and pork sector in Canada

depends on exports for two-thirds of

its income, Davidson says. Given this

dependence, it is crucial that foreign

market access be maintained and that

new markets be sought out and

developed.

“The negotiation of foreign market

access is an exclusive mandate of gov-

ernment; industry is critically

dependent upon the allocation of

sufficient government resources to

this function,” he says.

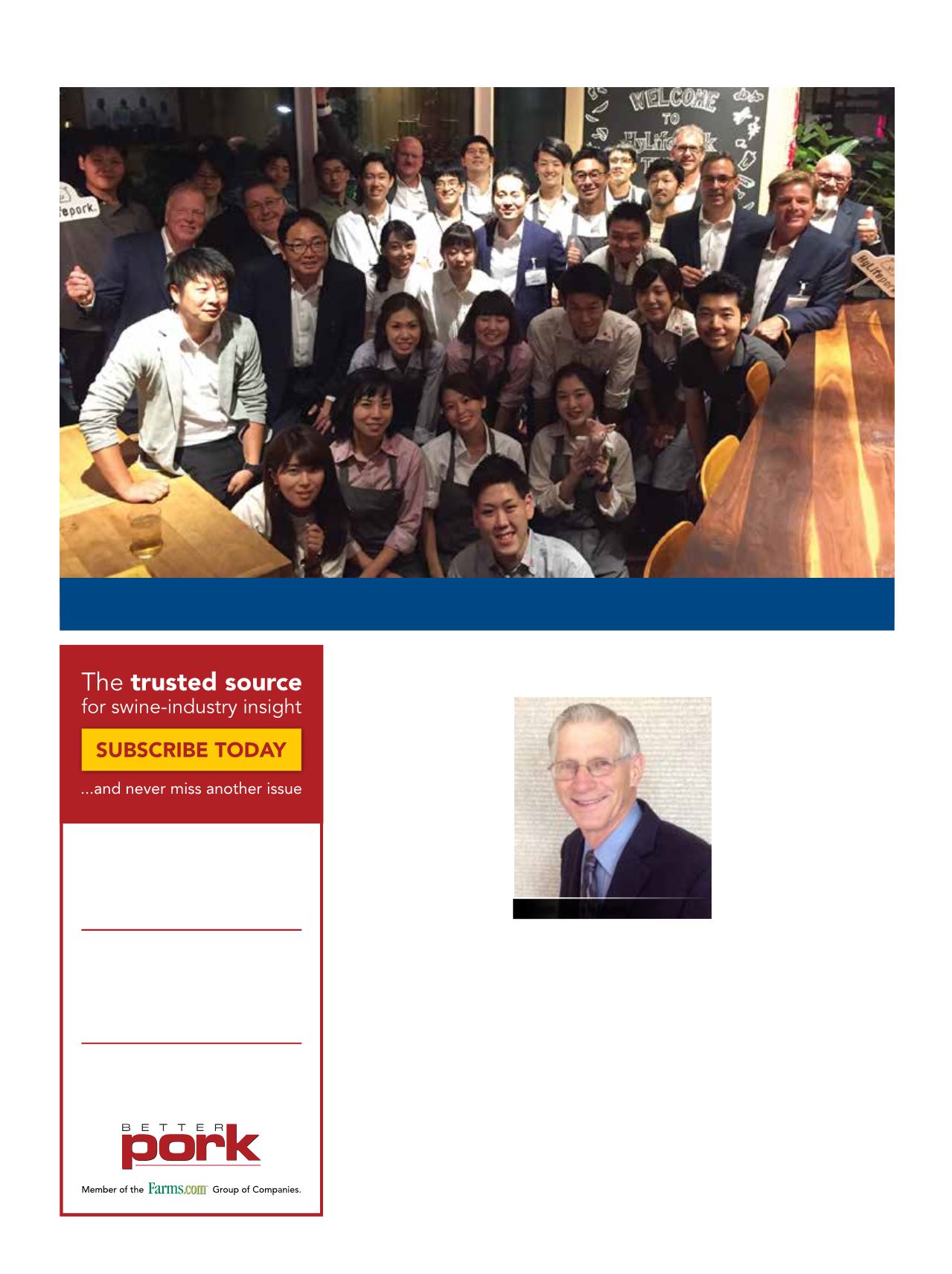

Claude Vielfaure/HyLife photo

Better Pork readers receive the top insight on business management advice and information. We’re the trusted source for Ontario’s pork producers. A $25 ONE-YEAR SUBSCRIPTION IS A 26% DISCOUNT ON NEWSSTAND PRICES. CALL 1-888-248-4893 EXT. 255Ron Davidson

HyLife’s Pork Table Restaurant in Japan. The Japanese consumer is a

connoisseur of pork according to Vielfaure.